LOYALTY CODE:

The paper code cannot be redeemed when browsing in private/incognito mode. Please go to a normal browser window and enter the code there

LOYALTY CODE:

The paper code cannot be redeemed when browsing in private/incognito mode. Please go to a normal browser window and enter the code there

This content is copyright protected!

However, if you would like to share the information in this article, you may use the headline, summary and link below:

Title: Grain markets heavily influenced by Russian and Ukrainian production

The huge expansion in grain production in Russia and Ukraine has fundamentally changed the dynamics of global grain trading.

https://www.farmersjournal.ie/grain-markets-heavily-influenced-by-russian-and-ukrainian-production-319484

ENTER YOUR LOYALTY CODE:

The reader loyalty code gives you full access to the site from when you enter it until the following Wednesday at 9pm. Find your unique code on the back page of Irish Country Living every week.

CODE ACCEPTED

You have full access to farmersjournal.ie on this browser until 9pm next Wednesday. Thank you for buying the paper and using the code.

CODE NOT VALID

Please try again or contact us.

For assistance, call 01 4199525

or email subs@farmersjournal.ie

Sign in

Incorrect details

Please try again or reset password

If would like to speak to a member of

our team, please call us on 01-4199525

Reset

password

Please enter your email address and we

will send you a link to reset your password

If would like to speak to a member of

our team, please call us on 01-4199525

Link sent to

your email

address

![]()

We have sent an email to your address.

Please click on the link in this email to reset

your password. If you can't find it in your inbox,

please check your spam folder. If you can't

find the email, please call us on 01-4199525.

![]()

Email address

not recognised

There is no subscription associated with this email

address. To read our subscriber-only content.

please subscribe or use the reader loyalty code.

If would like to speak to a member of

our team, please call us on 01-4199525

This is a subscriber-only article

This is a subscriber-only article

Update Success !

Last week, I wrote about the 80% increase in wheat yield in Russia, as outlined at the recent R&H Hall conference. This week, I stay on a somewhat similar theme, reporting on very interesting presentations on farming in Ukraine and Russia.

Opening the conference, R&H Hall group CEO Claudine Heron summed up these two countries by saying that they now produce almost 200 million tonnes between them and have become giants in the global export market, with about 90Mt potential exports.

Ukraine is forging ahead

Iryna Ivanova is CEO of an inputs supply company in Ukraine called Agroscope. It was established in 2002 and became an integral part of Origin Enterprises Group in 2014. The company’s objective is to provide added-value services to farmers to help increase crop and farm output and performance. She gave an overview of farming in Ukraine and its economy, which is slowly moving ahead to meet its potential as an agricultural producer.

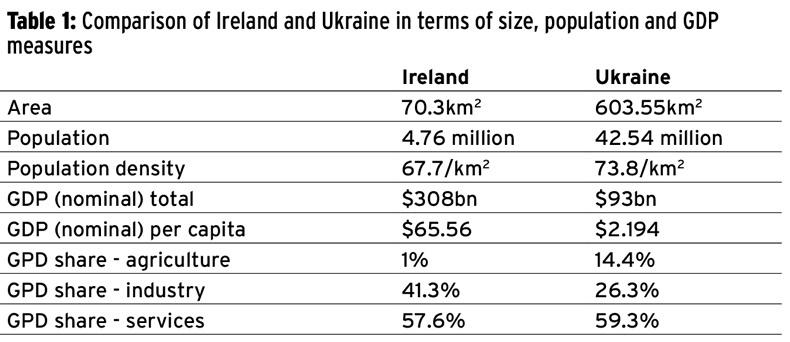

Ukraine is a big country at roughly 8.5 times the size of Ireland and almost 10 times our population. But while the population density is rather similar, its GDP is substantially lower, as shown in Table 1. War continues to be a drag on the moral and economic progress of the country, with up to 1.5 million people thought to be displaced both east and west from the war zone.

Of its 60.35 million hectares, 42.73 million are agricultural land and 32.54 million hectares of this is arable land. In total, there are about 40,000 farms farming around 22.7 million hectares of crops. About 8,000 of these farmers have >500ha and these farm about 19.6 million hectares in some combination of owned and leased land.

“These are big operations,” Iryna said. Many of them are big farming businesses which can frequently range in size from 50,000ha to 700,000ha. And she hinted that one of these had recently exceeded one million hectares.

There are a further 7,000 farms between 100ha and 500ha in size, farming 2.1 million hectares, and there are 25,000 farms with less than or equal to 100ha farming about one million hectares.

Sale of land

Sale of land is still not technically possible in Ukraine. Reforms have been put in place but they were not enabled and now it looks like these will be reformed yet again. Iryna commented that the delays are partly necessary because neither the legal system nor the mechanisms of sale are ready yet.

That said, the suggested sale value of land is indicated at around €1,000/ha while annual rent is around €100 to €200/ha. An estimated 80% of the farmed land is rented/leased currently. It is likely that the current users of land may be given first option to purchase when land sale is allowed, but there is great concern about land ownership falling into the hands of foreigners.

Iryna said that 44% of the agricultural land is controlled by agricultural companies, with a further 12% operated as private farms and the remaining 44% operated by what she calls households.

Exports

As of 13 October, the average yield of wheat was estimated to be 4.2t/ha, with maize yield running at 4.35t/ha.

The increasing significance of Ukraine in grain production can be seen in the fact that it exported some 45.1Mt of grains last season, of which 21.5Mt was maize, 18.1Mt was wheat and flour, while barley accounted for the remaining 5.5 Mt.

The EU is a very important market for Ukraine grains, as it currently imports over 50% of Ukrainian exports. This is up on 40% of Ukrainian common wheat exports and 63% of maize exports. It accounts for 14% of global maize trade.

It is also a very big exporter of vegetable oil from both sunflower and oilseed rape.

Export capacity

In 2007, Ukraine produced about 28 million tonnes of combinable crops; in 2017 that is expected to be about 64Mt. Expenditure on inputs is increasing, but it is much lower than the equivalent EU average spend. Sunflower is currently the most profitable crop followed by soya beans and then maize and oilseed rape.

Iryna said that export capacity through its ports is now put at about 60Mt following considerable investment in recent years. Last year, they exported about 42Mt total grains, so they can cope with a lot of additional production still to put pressure on global markets. Most of the export capacity is now owned by private companies and Iryna said that the only remaining state company is now about to be sold.

While there is very considerable port capacity, storage and transport capacity is much less developed. Considerable investment is required to improve both road and rail capacity to move products to ports for export.

Russia now a huge player

Farming businesses are also very much part of the agricultural landscape in Russia and these are very influential in the increased productivity that I reported from there in last week’s Irish Farmers Journal. Many of these are the legacy of the big collective farms and some of them have enormous scale. There is direct Russian investment in some of these, but many, if not most, have been propelled by foreign investment.

A few years ago, the Black Earth Farming business in Russia was featured at this conference by Richard Willows and this large 250,000ha business has since become part of an even bigger entity, Volgo-DonSelhozInvest.

Volgo-DonSelhozInvest is a Russian agriculture company that had operated over 200,000ha of farming land in its own right and several grain storage facilities. Its primary operations were located in the Volgograd and Lipetsk regions and it specialised in maize, sunflower and cereals. The company is ultimately owned by the Kukura family, which also has many other business interests.

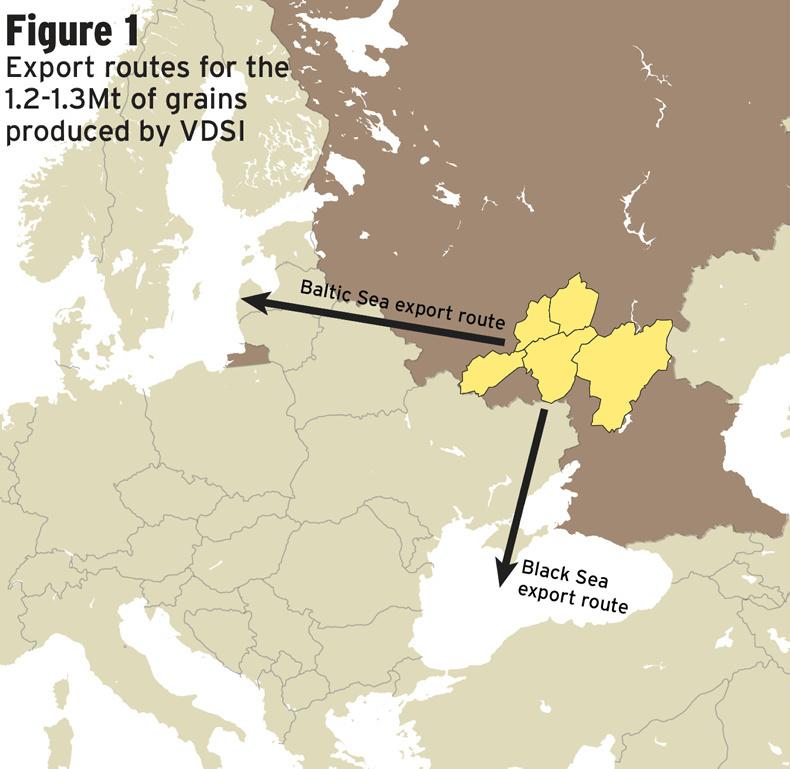

Volgo-Don or VDSI, as it is known, is now a farming business with a 450,000ha land base, 750,000t storage capacity and a fleet of machinery to help make it all happen. Richard is head of group sales, so he is responsible for selling the 1.2 to 1.3 million tonnes of grain produced by that business annually.

Richard has a background in commodity trading and, in recent years, he has specialised in marketing quality assured grains and oilseeds to the food industry, including direct exporting to key customers in the Baltics and Europe.

Risk management

With such a huge amount of grain to sell, risk management is a very important part of Richard’s job. His grain export programme is designed to reduce the risks associated with crop price levels through physical forward selling of grains, the guarantee of quality products and price hedging on futures and exchange markets. An amount of the total business is based on partnership in long-term contracts.

Richard commented that risk management gets more important as farming operations get bigger. For this reason, it becomes even more important to be able to control more of the various factors that affect their exports.

The main areas farmed are to the north and east of eastern Ukraine (see map). Grains are moved to market via the Black Sea to the southwest or out through the port of Liepaja in Latvia to the northwest. Port capacity in Russia is relatively limited and so partnerships with exporters are important to be able to secure timely delivery.

Production success

Crop production in Russia has been a great success story over the past decade. With the exception of 2010 and 2012, total crop output has been increasing for almost a decade and the past five years have seen spectacular performance in wheat output in particular. Since 2012, Russia has seen a 180% increase in its exportable wheat surplus as a consequence of its yield performance.

Total grain production in Russia in 2017 is currently put at over 133Mt, with wheat being the single-biggest crop at around 83Mt, of which about 33Mt is said to be available for export.

However, Richard questioned the possibility that these massive recent production levels may have been overstated. He wondered if political pressure to show continuous performance improvement could be leading to an over-stating of output levels.

He made this comment because the actions of producers are not in line with what one might expect if these output levels were accurate. There is also the issue of stock levels. Official figures suggest a 19Mt grain carry-in to the current harvest, with up to 28.8Mt end-of-season stocks. Wheat stocks at the end of the current marketing year are suggested to be 20.2Mt.

Stocks queried

Richard commented that this level of theoretical stock must, at some point, affect overall storage capacity, leaving insufficient space for harvest storage.

This would be seen as aggressive shipping of Russian grain for weeks or months post-harvest, but this did not appear to happen.

While there was some low-cost selling, Russian prices hardened once the main harvest pressure eased.

Last harvest (2016), Russia generated an expectation of very significant grain export levels post-harvest. However, by December, the level of potential grain exports was decreased, supposedly as a result of very high internal demand.

While domestic consumption has been increasing considerably (and is put at 80Mt for this season), that announcement either means that production and stocks are not as high as forecast or that internal consumption is moving at an even faster rate.

On-farm performance

In discussion, both Richard and Iryna indicated that the overall cropping area has been relatively stable in both countries for quite a period and that the major driver of increased output was grain yield.

While there may have been a slight area increase in Russia, both agreed that it is the combination of superior varieties, fertilisation and modern plant protection methods that have together driven these increases in output levels.

Weather remains a factor. The last few years are regarded as having been favourable for production and this is still seen as an important ingredient for the high output recorded. But weather equally provides a threat to output and this will still happen on occasions in the future.

Asked where they thought national grain output could rise to, Richard said that a 150Mt harvest is seen as realistic for Russia in the years ahead, which is an additional 17Mt on the record output level this year.

And in Ukraine, the estimated output for 2017 is put at about 64Mt, slightly lower than 2016, but Iryna suggested that continuous technological improvement could see this rise to 80Mt-plus and even 100Mt in the longer term.

Asked about land use patterns, Richard indicated that wheat area and production will increase into the future in Russia.

It is not so easy to say what will be displaced, but the feeling is that it will be the minor crops.

In Ukraine, the trend is likely to be towards increased maize production, with barley, in particular, being the crop that looks to be reducing in area to facilitate this expansion in maize.

Both countries have benefited from the recent expansion in their crops sector and both have become very significant global exporters.

Internal infrastructure is limiting for export capacity in both countries. Ukraine has the port capacity, but limited transport infrastructure, while Russia theoretically suffers from both.

That said, infrastructure can be built to move increasingly big internal crops and perhaps the more important question is the increasing level of internal use for livestock production, especially in Russia.

SHARING OPTIONS: