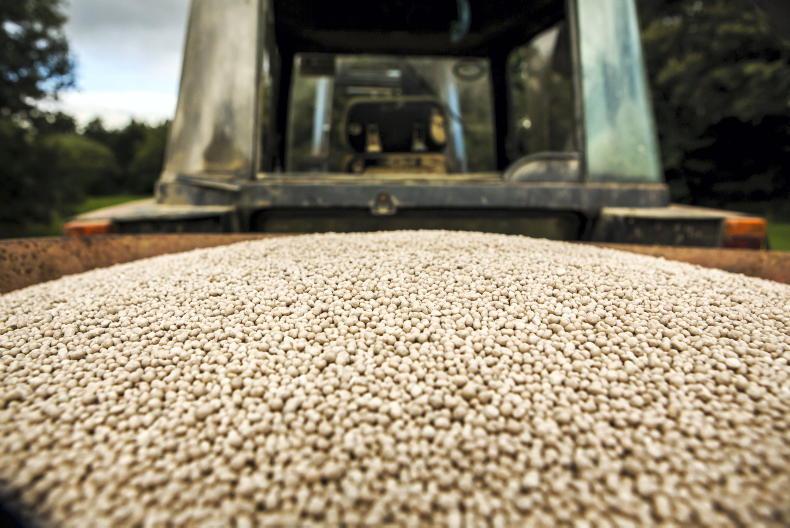

The nitrogen poker challenge is up and running. With nitrogen prices reaching new heights we sat down with Grassland Agro managing director Liam Woulfe to discuss what exactly is happening.

One of the big issues in the trade is with nitrogen prices north of €800 per tonne for urea, those importing and contract purchasing stocks of nitrogen are very slow to move. Why?

One of the reasons is they can’t be sure the price won’t fall and if they have deals done at high prices, depending on the size of the price move, a big fall in prices could, potentially, put them out of business.

In this short video, Liam Woulfe explains that in 2009 the price of urea fell €100/t and it was left to the importers to carry the cost of the more expensive product.

As he says, while it was a bitter bill to swallow a seven-figure sum for his business, this time around with the price where it is now, the fall could be at least four times what it was in 2009. A downward shift of that scale could put an importing business to the wall.

The back story to that 2009 price slide is the importers, such as Grassland Agro, had purchased in autumn 2008 in order to have nitrogen in stock for early 2009.

The world market price fell, the importers had to stick to the price agreed and pay up, but the farmers had other options. The price to the farmer fell in a competitive market.

With the muscle memory of this 2009 event and the current price of a tonne of urea double or treble the price of what it was then, the stakes are a lot higher this time around.

As well as being Grassland Agro MD, Liam Woulfe has been in the fertiliser business for the last 20 years.

He has never seen the geopolitical influence on the fertiliser market as important and the potential impact that it could have on farmers stocks.

SHARING OPTIONS