The UK buys just over a quarter of all Irish dairy exports, which in 2018 were €4bn. Of the approximately €1bn of dairy sales to the UK, €800m is cheddar cheese with some butter and indeed milk to Northern Ireland for the production of Baileys Irish Cream liqueur.

Listen to "Brexit tariff to hit beef by €1.20/kg" on Spreaker.

Current cheddar value is around €3,000t and in the proposed schedule of UK tariffs would have a tariff of €220/t applied, a cost but not a crippling cost for cheddar sales.

Butter is more vulnerable. The proposed UK tariff of €605/t applied to butter currently trading at €4,000/t would represent a 15% increase.

A major impact in the dairy sector would be for Northern Ireland farmers, who currently send one-third of their milk south for processing. In a no-deal situation with the EU applying full WTO tariffs, this would no longer be viable.

The UK is Ireland’s main export market, taking 56% of all exports in 2018. As pigmeat is a globally traded product, the UK has opted for a tariff that is 13% of the full WTO tariff. That would make Irish pig carcases 7c/kg or 5% more expensive going into the UK market than at present, while 11c/kg of tariff would be added to boneless pigmeat. The direct effect will be also felt by the farmers who sent 466,000 pigs north last year for processing.

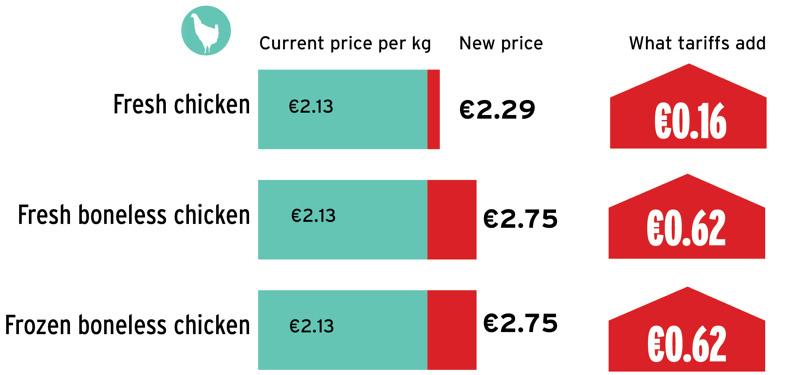

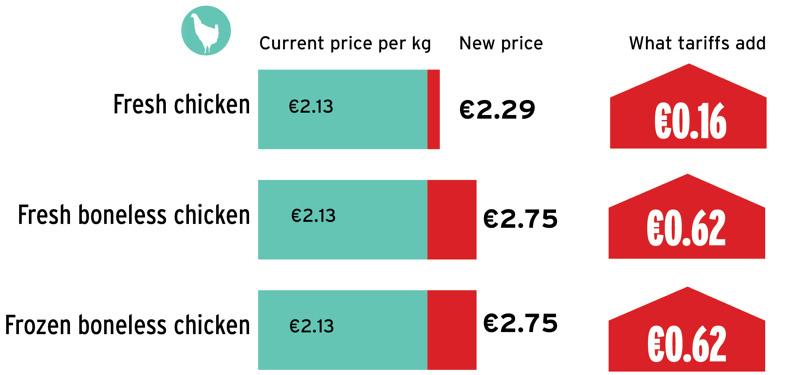

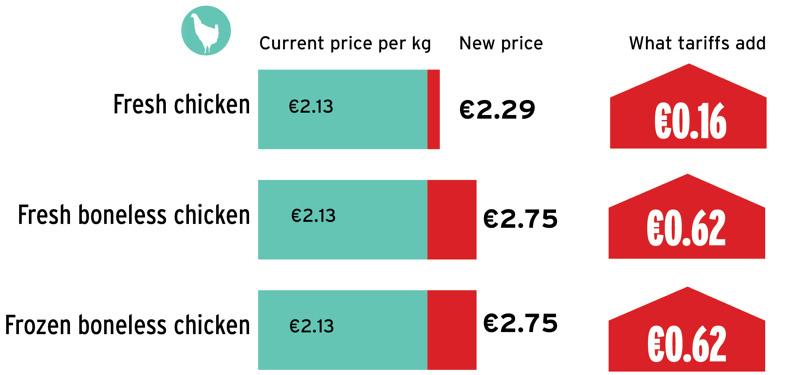

The Irish poultry industry produced 157,000t of poultry meat last year and had an export value of €316m, of which two-thirds was from the UK. The UK government has set a tariff of €0.16/kg on fresh chicken and €0.62/kg on boneless fresh and frozen chicken. In what is a business with wafer-thin margins, these tariffs would make Irish produce uncompetitive in its main export market.

Brexit is bad news for every sector of the Irish agricultural sector but it is most devastating for the beef sector which exported 298,000t to the UK last year. In a sector that is already under pressure, there is simply no capacity to carry the level of tariffs that have been set by the UK. Working off a current Irish base price of €3.80/kg, an Irish beef carcase shipped to the UK would carry a tariff of €1.19/kg. This is made up of a charge of 6.8% of the carcase value plus a rate per kilo of €0.93/kg and would push the cost of a €3.80/kg carcase up to €4.99/kg going into Britain. This is an increase of 30%. Assuming this cost is passed back to the farmer, the Irish base price would fall from €3.80/kg to €2.61/kg.

Interestingly, if the destination was Northern Ireland, which takes approximately 50,000 Irish carcases per annum, these would be excluded under the UK Government policy of not charging a tariff on imports from the south.

Tariff rates

The main beef export from Ireland to Britain is either fresh or frozen boneless beef. This will carry a UK tariff of 6.8% of the value of the cut exported, plus €1.60/kg on fresh and €1.61/kg on frozen. There are several variations of tariffs on beef but these represent the largest volume of sales.

While these tariffs would be crippling for the Irish beef industry, they would actually be quite affordable for Brazil where the beef price is around €2.20/kg compared with a €3.80/kg base in Ireland.

Brazilian striploins are currently trading internationally at €6.50/kg, half of the Irish price, so this UK tariff would still leave them cheaper than Irish.

Tariff-free quota the

biggest threat

Tariffs are only part of the story for Irish beef producers. It is the tariff-free quota that will really undermine the Irish beef industry.

An annual 124,000t fresh beef quota and a 57,000t frozen beef quota is being created by the UK in the event of no deal.

The problem with this is that Brazil will have the same level of access as Ireland to this quota and the value of the UK beef market will be decimated. This will also negatively affect Northern Ireland Red Tractor and Scottish beef as its premium of 10% to 15% will be on top of a lower base.

Sheepmeat is the least exposed sector of agriculture in the Republic of Ireland even though the UK is applying a full WTO tariff of 12.8% of the value plus €1.71/kg on lamb carcases. For sheepmeat producers in the north and Britain, the opposite is the case. The 423,000 lambs last year that came south and British exports to the continent will be decimated by carrying full tariffs.The UK currently takes 17% of Irish sheepmeat exports but with the UK, which is the third biggest exporter of sheepmeat in the world effectively excluded by tariffs, a market opportunity would be created for sheepmeat producers in the Republic of Ireland at the expense of their counterparts in Northern Ireland.

The lamb situation in the UK is complicated by taking its share of the EU-New Zealand sheepmeat quota, which is over 100,000t.

Read more

Exclusive: UK beef tariffs become reality

The UK buys just over a quarter of all Irish dairy exports, which in 2018 were €4bn. Of the approximately €1bn of dairy sales to the UK, €800m is cheddar cheese with some butter and indeed milk to Northern Ireland for the production of Baileys Irish Cream liqueur.

Listen to "Brexit tariff to hit beef by €1.20/kg" on Spreaker.

Current cheddar value is around €3,000t and in the proposed schedule of UK tariffs would have a tariff of €220/t applied, a cost but not a crippling cost for cheddar sales.

Butter is more vulnerable. The proposed UK tariff of €605/t applied to butter currently trading at €4,000/t would represent a 15% increase.

A major impact in the dairy sector would be for Northern Ireland farmers, who currently send one-third of their milk south for processing. In a no-deal situation with the EU applying full WTO tariffs, this would no longer be viable.

The UK is Ireland’s main export market, taking 56% of all exports in 2018. As pigmeat is a globally traded product, the UK has opted for a tariff that is 13% of the full WTO tariff. That would make Irish pig carcases 7c/kg or 5% more expensive going into the UK market than at present, while 11c/kg of tariff would be added to boneless pigmeat. The direct effect will be also felt by the farmers who sent 466,000 pigs north last year for processing.

The Irish poultry industry produced 157,000t of poultry meat last year and had an export value of €316m, of which two-thirds was from the UK. The UK government has set a tariff of €0.16/kg on fresh chicken and €0.62/kg on boneless fresh and frozen chicken. In what is a business with wafer-thin margins, these tariffs would make Irish produce uncompetitive in its main export market.

Brexit is bad news for every sector of the Irish agricultural sector but it is most devastating for the beef sector which exported 298,000t to the UK last year. In a sector that is already under pressure, there is simply no capacity to carry the level of tariffs that have been set by the UK. Working off a current Irish base price of €3.80/kg, an Irish beef carcase shipped to the UK would carry a tariff of €1.19/kg. This is made up of a charge of 6.8% of the carcase value plus a rate per kilo of €0.93/kg and would push the cost of a €3.80/kg carcase up to €4.99/kg going into Britain. This is an increase of 30%. Assuming this cost is passed back to the farmer, the Irish base price would fall from €3.80/kg to €2.61/kg.

Interestingly, if the destination was Northern Ireland, which takes approximately 50,000 Irish carcases per annum, these would be excluded under the UK Government policy of not charging a tariff on imports from the south.

Tariff rates

The main beef export from Ireland to Britain is either fresh or frozen boneless beef. This will carry a UK tariff of 6.8% of the value of the cut exported, plus €1.60/kg on fresh and €1.61/kg on frozen. There are several variations of tariffs on beef but these represent the largest volume of sales.

While these tariffs would be crippling for the Irish beef industry, they would actually be quite affordable for Brazil where the beef price is around €2.20/kg compared with a €3.80/kg base in Ireland.

Brazilian striploins are currently trading internationally at €6.50/kg, half of the Irish price, so this UK tariff would still leave them cheaper than Irish.

Tariff-free quota the

biggest threat

Tariffs are only part of the story for Irish beef producers. It is the tariff-free quota that will really undermine the Irish beef industry.

An annual 124,000t fresh beef quota and a 57,000t frozen beef quota is being created by the UK in the event of no deal.

The problem with this is that Brazil will have the same level of access as Ireland to this quota and the value of the UK beef market will be decimated. This will also negatively affect Northern Ireland Red Tractor and Scottish beef as its premium of 10% to 15% will be on top of a lower base.

Sheepmeat is the least exposed sector of agriculture in the Republic of Ireland even though the UK is applying a full WTO tariff of 12.8% of the value plus €1.71/kg on lamb carcases. For sheepmeat producers in the north and Britain, the opposite is the case. The 423,000 lambs last year that came south and British exports to the continent will be decimated by carrying full tariffs.The UK currently takes 17% of Irish sheepmeat exports but with the UK, which is the third biggest exporter of sheepmeat in the world effectively excluded by tariffs, a market opportunity would be created for sheepmeat producers in the Republic of Ireland at the expense of their counterparts in Northern Ireland.

The lamb situation in the UK is complicated by taking its share of the EU-New Zealand sheepmeat quota, which is over 100,000t.

Read more

Exclusive: UK beef tariffs become reality

SHARING OPTIONS