Everyone will remember 2012 as being a record-breaking year for live cattle prices. A scarcity of stock combined with rising beef prices fuelled the price increase in that year.

MartWatch analysis of the live trade over the course of 2015 shows that live cattle prices have surpassed the peak levels seen in 2012. However, in the last two months of trading, store cattle prices have fallen by about 10c/kg driven by a less positive outlook in the beef sector.

Store cattle bullocks

up 21c/kg

This week, we will analyse the store cattle trade throughout 2015. If we look at the trend in store bullock prices through the spring time, we can see that from February through to August prices were strong and peaked in April and again in August. From November onwards, price weakened noticeably.

Despite a 20c/kg fall from November to the end of the year, average prices for store bullocks were up 21c/kg on 2014, and 5c to 6c/kg higher than the previous peak in 2012.

Average prices for both 400kg to 500kg and 500kg to 600kg store bullocks were up about the same on a cent per kilogramme basis.

This 10% increase in average cattle prices in 2015 impacted on farmer buyers. It caused many to move to buying lighter animals than they would traditionally have purchased to secure the numbers required within the cashflow restraints on the farm.

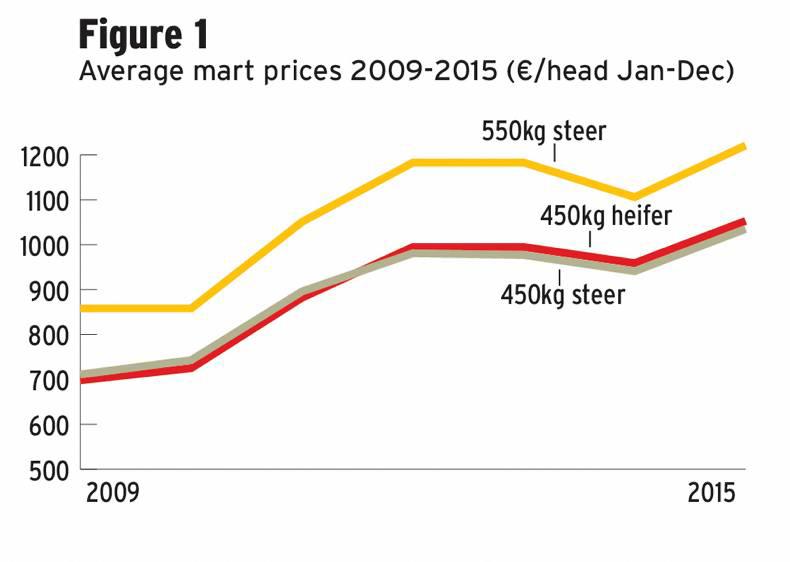

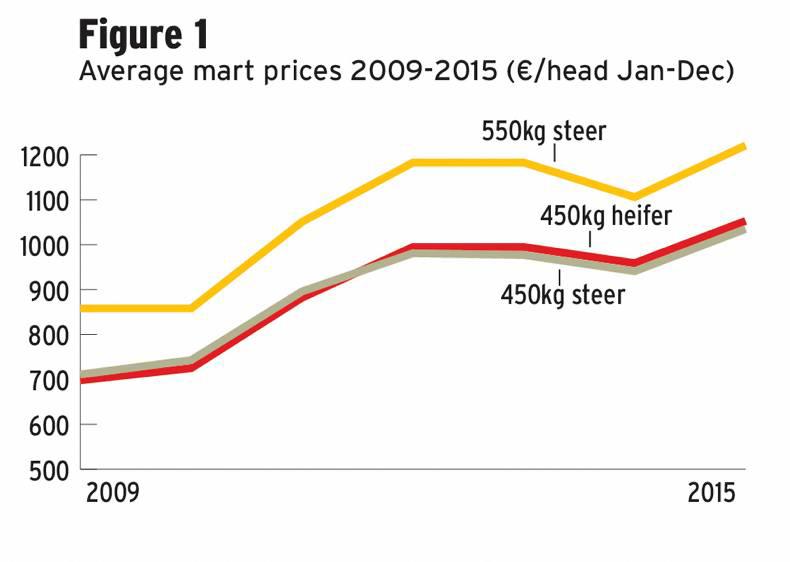

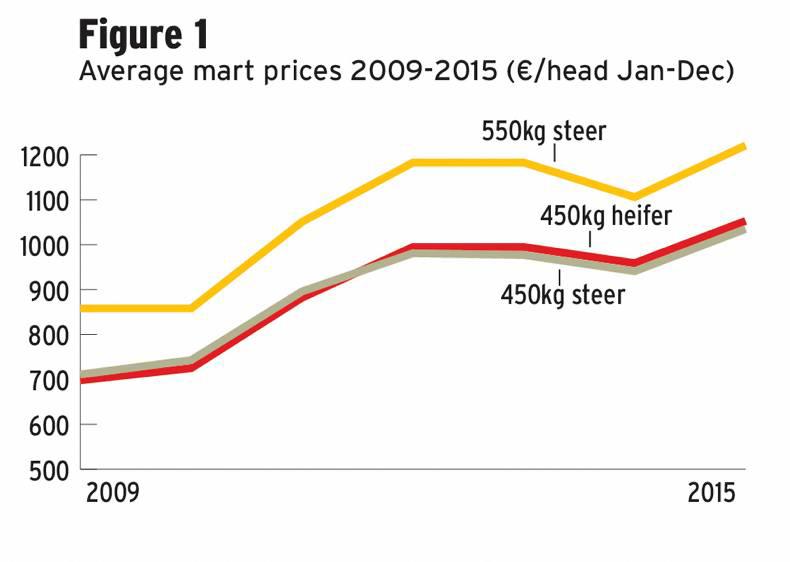

If we look it on value terms, the average 550kg steer in 2015 made €1,221/head, up €105 on 2014 and up €38/head on 2012 and 2013 levels. If we look at a 450kg steer, they sold for €1,035/head on average across 2015, up €76 on 2014 and €54 above 2012 levels.

Differential narrows for 400-500kg bullocks

When cattle prices are high, one common feature is that the difference in price between top-quality cattle and average-quality cattle often decreases due to supply and demand.

Over the course of 2015, we have seen the differential in price paid between the top and bottom quality bullocks between 400kg and 500kg reduced by 9c/kg, as the average price paid for the bottom third of bullocks in the category actually increased by 33c/kg on 2014 levels. However, this was the only class of store cattle that this trend was evident in. Heavy store bullocks and heifers did not show this trend.

Heifer prices up 19-21c/kg on 2014 levels

Analysis of average prices for heifers across the year has shown that prices have increased to a similar level as the equivalent store bullock.

The MartWatch review has shown that heifers from 500kg to 600kg have seen average prices increase by 19c/kg or €105/head in 2015 when compared with the previous year. Both the top and bottom third in quality terms in the same weight range saw prices up by as much as 23c/kg on the previous year.

Lighter store heifer prices were even stronger in comparison. The average 400kg to 500kg heifer sold for €2.34/kg on average in 2015, up by 21c/kg on the average price paid in 2014 for the same type of heifer.

The top third of heifers in terms of quality in the same weight range sold for €2.64/kg, up by 23c/kg from €2.41/kg in 2014. The average price paid in 2015 was 13c/kg higher than the previous peak in 2012 and 2013. In value terms, the average 450kg heifer sold for €1,053 in 2015, up by €94/head on the previous year.

Prices falling since

November

Despite average prices being very strong throughout the year, since November there has been a trend of a weakening trade.

Both store bullock and heifer prices have fallen by about 10c/kg since early November, but in the weeks prior to Christmas, the trade had steadied once again at a lower level.

This coincided with more negative short-term prospects for beef price. This had reduced finisher demand. In addition to this, the more rigid enforcement of carcase specifications, in particular age, weight and movements, has had an impact on the live trade in the same period. Buyers have become much less active for aged cattle and those that will be slaughtered at high weights. At the ringside, this has equated to aged and heavy cattle being a much slower sell compared with their counterparts. In many areas, mart managers commented that these types were selling for over €100/head less than an underage animal.

Next week, we will continue the review with weanling, cow and calf price analysis.

Everyone will remember 2012 as being a record-breaking year for live cattle prices. A scarcity of stock combined with rising beef prices fuelled the price increase in that year.

MartWatch analysis of the live trade over the course of 2015 shows that live cattle prices have surpassed the peak levels seen in 2012. However, in the last two months of trading, store cattle prices have fallen by about 10c/kg driven by a less positive outlook in the beef sector.

Store cattle bullocks

up 21c/kg

This week, we will analyse the store cattle trade throughout 2015. If we look at the trend in store bullock prices through the spring time, we can see that from February through to August prices were strong and peaked in April and again in August. From November onwards, price weakened noticeably.

Despite a 20c/kg fall from November to the end of the year, average prices for store bullocks were up 21c/kg on 2014, and 5c to 6c/kg higher than the previous peak in 2012.

Average prices for both 400kg to 500kg and 500kg to 600kg store bullocks were up about the same on a cent per kilogramme basis.

This 10% increase in average cattle prices in 2015 impacted on farmer buyers. It caused many to move to buying lighter animals than they would traditionally have purchased to secure the numbers required within the cashflow restraints on the farm.

If we look it on value terms, the average 550kg steer in 2015 made €1,221/head, up €105 on 2014 and up €38/head on 2012 and 2013 levels. If we look at a 450kg steer, they sold for €1,035/head on average across 2015, up €76 on 2014 and €54 above 2012 levels.

Differential narrows for 400-500kg bullocks

When cattle prices are high, one common feature is that the difference in price between top-quality cattle and average-quality cattle often decreases due to supply and demand.

Over the course of 2015, we have seen the differential in price paid between the top and bottom quality bullocks between 400kg and 500kg reduced by 9c/kg, as the average price paid for the bottom third of bullocks in the category actually increased by 33c/kg on 2014 levels. However, this was the only class of store cattle that this trend was evident in. Heavy store bullocks and heifers did not show this trend.

Heifer prices up 19-21c/kg on 2014 levels

Analysis of average prices for heifers across the year has shown that prices have increased to a similar level as the equivalent store bullock.

The MartWatch review has shown that heifers from 500kg to 600kg have seen average prices increase by 19c/kg or €105/head in 2015 when compared with the previous year. Both the top and bottom third in quality terms in the same weight range saw prices up by as much as 23c/kg on the previous year.

Lighter store heifer prices were even stronger in comparison. The average 400kg to 500kg heifer sold for €2.34/kg on average in 2015, up by 21c/kg on the average price paid in 2014 for the same type of heifer.

The top third of heifers in terms of quality in the same weight range sold for €2.64/kg, up by 23c/kg from €2.41/kg in 2014. The average price paid in 2015 was 13c/kg higher than the previous peak in 2012 and 2013. In value terms, the average 450kg heifer sold for €1,053 in 2015, up by €94/head on the previous year.

Prices falling since

November

Despite average prices being very strong throughout the year, since November there has been a trend of a weakening trade.

Both store bullock and heifer prices have fallen by about 10c/kg since early November, but in the weeks prior to Christmas, the trade had steadied once again at a lower level.

This coincided with more negative short-term prospects for beef price. This had reduced finisher demand. In addition to this, the more rigid enforcement of carcase specifications, in particular age, weight and movements, has had an impact on the live trade in the same period. Buyers have become much less active for aged cattle and those that will be slaughtered at high weights. At the ringside, this has equated to aged and heavy cattle being a much slower sell compared with their counterparts. In many areas, mart managers commented that these types were selling for over €100/head less than an underage animal.

Next week, we will continue the review with weanling, cow and calf price analysis.

SHARING OPTIONS