FBD reported profits of €52.9m last year -an increase of 5.3% though gross written premium income contracted by 2%, according to the insurance company’s annual report published this week.

The positive results were achieved in an Irish insurance market which contracted by 5.5% last year on top of the 4.9% market decline in 2011.

FBD is to increase its final dividend to 30 cent per share- an increase of 29% and a full year dividend growth of 22.5%.

It is a significant dividend rise and reflects the group’s decision to increase dividend pay-out ratio over the coming years to between 40 and 50% of profits.

FBD’s broker channel now accounts for 46% of new business. Some 70% of all business customers are now sourcing their insurance through brokerages.

The policies written through brokers in urban centres more than offset the decline within their direct customers’ division.

FBD increased its share of new farming business during the year by 2,600 polices.

The group’s financial services division recorded operating profits of €5.6m- a rise of over 30%. This was boosted by its premium instalment service and its “Agri Bond” product – a tracker bond sold to FBD’s agri customer base.

Claims

The favourable weather of the past two years (no freeze-ups, storms or flooding) saw net claims at FBD come out at €191m – down by 5% over 2011. This resulted in a combined operating ratio of 89.1% (2011, 91.4%).

Road deaths were also down in 2012 -the lowest since records began in 1959.

Competition

FBD chief executive, Andrew Langford, told the Irish Farmers Journal this week that the insurance market remained extremely competitive, especially for home insurance and large risk premiums.

FBD remained cautious on risk pricing and selection, he said, and did not compete solely on price.

On Zurich’s recent entry into the agri insurance market Langford said; “We complete not just on price, but also on service, pay-out ratio and products specifically tailored for our farmer customers.

“Our office structure throughout the country are staffed by people that understand farming”.

Financials

This year’s robust results further strengthened FBD’s balance sheet and solvency ratios. Its net asset value increased by 14.4% to 721 cent per share and its solvency level by 73.5%, from 66% in 2011.

The FBD share price currently trades on a 2012 PE of 8 times and offers a dividend yield of 3.2% and is up almost 26% so far this year. This is on top a 55% increase last year.

FBD continued to adopt a conservative stance on investment markets and increased its cash holdings by €154m to 59% last year and remained out of the over- priced and low yielding government and corporate bond markets.

Strategic Initiatives

FBD made a profit of €5m last year from the sale of lands and sold its reinsurance arm, Abbey Re, booking a profit of €4.1m.

Its joint venture (JV) with Farmer Business Development for its hotel and leisure division recorded losses of €3.4m of which FBD records 50% given its JV stake.

However, the joint venture reduced its debt by 25% during the year and refinanced its banking facilities with one lender thereby providing this division with more certainty going forward.

FBD also booked a €2.6m write down on the group’s legacy investment in Bloxham stockbrokers, which went into liquidation last year.

Other provisions included €3.1m on onerous leases and a restructuring charge of €2.1m which, when combined, saw total profits before tax fall to €52.9m (2011, €59.7m).

Key points

FBD reported profits of €52.9m last year -an increase of 5.3% though gross written premium income contracted by 2%, according to the insurance company’s annual report published this week.

The positive results were achieved in an Irish insurance market which contracted by 5.5% last year on top of the 4.9% market decline in 2011.

FBD is to increase its final dividend to 30 cent per share- an increase of 29% and a full year dividend growth of 22.5%.

It is a significant dividend rise and reflects the group’s decision to increase dividend pay-out ratio over the coming years to between 40 and 50% of profits.

FBD’s broker channel now accounts for 46% of new business. Some 70% of all business customers are now sourcing their insurance through brokerages.

The policies written through brokers in urban centres more than offset the decline within their direct customers’ division.

FBD increased its share of new farming business during the year by 2,600 polices.

The group’s financial services division recorded operating profits of €5.6m- a rise of over 30%. This was boosted by its premium instalment service and its “Agri Bond” product – a tracker bond sold to FBD’s agri customer base.

Claims

The favourable weather of the past two years (no freeze-ups, storms or flooding) saw net claims at FBD come out at €191m – down by 5% over 2011. This resulted in a combined operating ratio of 89.1% (2011, 91.4%).

Road deaths were also down in 2012 -the lowest since records began in 1959.

Competition

FBD chief executive, Andrew Langford, told the Irish Farmers Journal this week that the insurance market remained extremely competitive, especially for home insurance and large risk premiums.

FBD remained cautious on risk pricing and selection, he said, and did not compete solely on price.

On Zurich’s recent entry into the agri insurance market Langford said; “We complete not just on price, but also on service, pay-out ratio and products specifically tailored for our farmer customers.

“Our office structure throughout the country are staffed by people that understand farming”.

Financials

This year’s robust results further strengthened FBD’s balance sheet and solvency ratios. Its net asset value increased by 14.4% to 721 cent per share and its solvency level by 73.5%, from 66% in 2011.

The FBD share price currently trades on a 2012 PE of 8 times and offers a dividend yield of 3.2% and is up almost 26% so far this year. This is on top a 55% increase last year.

FBD continued to adopt a conservative stance on investment markets and increased its cash holdings by €154m to 59% last year and remained out of the over- priced and low yielding government and corporate bond markets.

Strategic Initiatives

FBD made a profit of €5m last year from the sale of lands and sold its reinsurance arm, Abbey Re, booking a profit of €4.1m.

Its joint venture (JV) with Farmer Business Development for its hotel and leisure division recorded losses of €3.4m of which FBD records 50% given its JV stake.

However, the joint venture reduced its debt by 25% during the year and refinanced its banking facilities with one lender thereby providing this division with more certainty going forward.

FBD also booked a €2.6m write down on the group’s legacy investment in Bloxham stockbrokers, which went into liquidation last year.

Other provisions included €3.1m on onerous leases and a restructuring charge of €2.1m which, when combined, saw total profits before tax fall to €52.9m (2011, €59.7m).

Key points

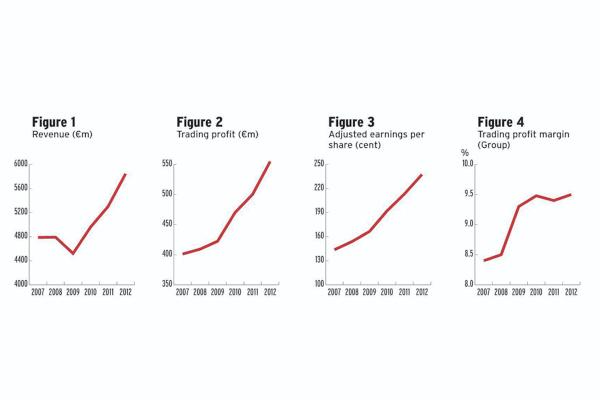

Profits before tax up 5.3%Dividends up 22.5% to 42.25 centFuture dividend pay-out 40-50%Gross income down 2%Market share up to 12.5%Claim costs down 5% to €191mShare price up 26% YTD

SHARING OPTIONS