In recent weeks the majority of grain buyers announced their green grain prices. While the price disappointed, it was driven by international markets that have been generally weak over the past 12 months.

2015 was another bumper harvest and it is estimated at 2.5 million to 2.6 million tonnes (mt), similar to last year. Higher yields and greater focus on winter cereals made up for reduced planted area.

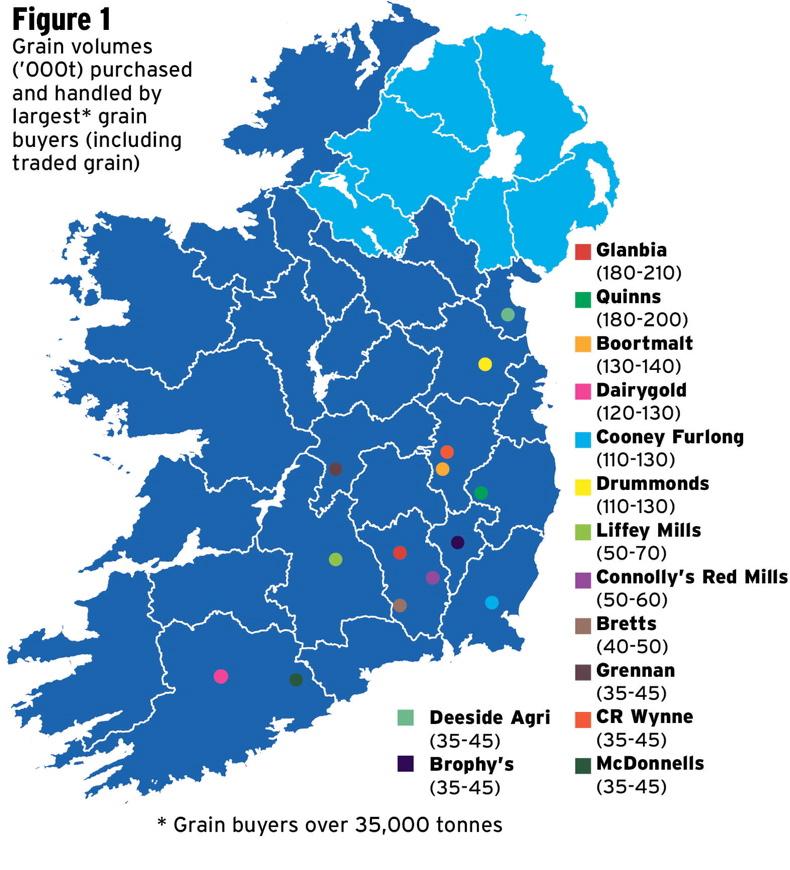

About 1.5mt to 1.7mt is bought and handled every year by the grain buyers. The balance (approx. 0.8mt) is a combination of inter-farm trading, home drying and direct to end users.

Seven buyers account for 70% of the grain that’s bought and handled in Ireland. Glanbia are the largest grain buyer, accounting for 16%, followed closely by Quinn’s of Baltinglass who are now buying close to 200,000t or 13%. There are two main buyers of malting barley in Ireland – Boortmalt in Athy and The Malting Company of Ireland (MCI) in Cork (this is initially purchased by Glanbia and Dairygold). Between them, they purchase in excess of 160,000t of green barley to produce about 120,000t of malt.

There is also a demand for 40,000t of barley for milling and roasting each year, which is used by Diageo in the production of Guinness. The main buyers here are Glanbia and Cooney Furlong/Cooney Group in Wexford – the fifth largest grain buyers in the country.

Dairygold purchased almost 130,000t of grain this year, accounting for 9% of the total. Drummonds handle 110,000t to 130,000t, depending on the year.

Significant investment

Thanks to larger yields today, cereal output is produced from about 300,000ha compared to about 450,000ha in the early 1980s. As farmers have increased their yields –thanks to improved varieties, management and agronomy – to deliver the record harvests, it has brought its own challenges further up the chain.

Farm machinery has gotten exponentially larger, which has caused bottle necks at grain intakes. Combines can now easily harvest 60t to 70t/hr, while tractor trailers deliver up to 28t, and yet they had been delivering into grain intakes built for a different era – 10t trailers and 10ft combines.

While the majority (more than 85%) is used in the production of feed for animals, more and more is going towards premium markets.

After decades of stagnation and lack of investment, more than €50m has been invested in grain handling facilities, particularly driers and conveyors in the last five years.

While overall storage capacities have not increased, there has been significant investment in new stores along with the upgrading of existing facilities.

Future outlook

To reach targets set out by the Irish Whiskey Association, the distilling sector would need to double barley consumption from the present 65,000t to 70,000t to up on 140,000t per annum.

Malt consumption (for distilling) would need to increase from the current 30,000t per annum to 40,000t within the same period.

In recent years, the oat sector has seen something of a revival. No longer seen as fuel for horses, more is used directly as food for humans.

Glanbia, who has invested in a new oat mill in Portlaoise, buys 8,000t to 12,000t of oats for human consumption for the export market – particularly the US. Flahavan’s is also expanding and currently uses around 14,000t of conventional oats plus a further 4,000t of organic oats.

Connolly’s Red Mills uses about 20,000t of oats to produce horse and dog food. Along with Glanbia, it is also now exporting to the sport horse world to places as far away as Japan.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: