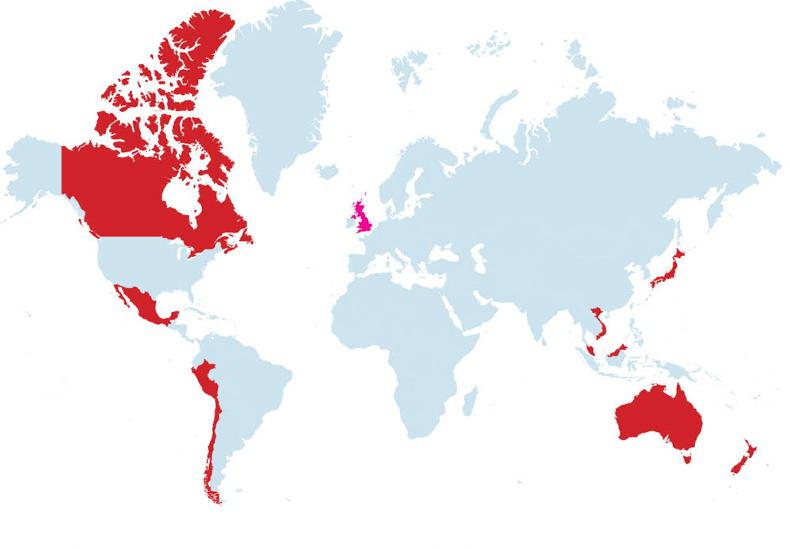

The UK marked the first anniversary of leaving the EU by applying to join the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP). This is a group of countries that border the Pacific Ocean on both sides, with Canada, Mexico, Chile and Peru joining the Asian countries of Japan, Malaysia, Brunei, Singapore and Vietnam plus Australia and New Zealand.

What is CPTPP?

The CPTPP is a trade grouping with the objective of securing 95% of trade between members tariff free. It is very different from the EU in that it is neither a customs union nor a single market. That means non-tariff barriers remain though a move to streamline and standardise these would have the effect of simplifying trade between group members. Being part of the CPTPP also allows members separately negotiate their own free-trade deals as Canada and Japan have done with these rolled over with the UK on their departure from the EU.

The partnership also provides for members to retain tariffs and quotas to protect sensitive areas which often involve agriculture. For example, Japan which is hugely protective of its farmers has only liberalised one-third of its tariff lines, as has Vietnam, though in its case this will rise to two-thirds after 15 years.

Farmers exposed

The UK government has not indicated what it expects its economy to gain from joining the CPTPP, assuming the application is successful. Currently this group of countries account for 9% of UK exports.

The UK is the fifth largest economy in the world, so it will always be an attractive market across all goods and services. However, the speed with which Beef+Lamb New Zealand and the NZ meat processing industry welcomed the application is an indication that access to the UK beef, sheepmeat and dairy market will be a target for them.

Canada, Australia and NZ

NZ and Australia are also in negotiation with the UK separately about specific trade deals so, either way, it looks inevitable that the UK market will be open to NZ beef and dairy in addition to their already generous quota for sheepmeat.

Australia doesn’t have a large sheep-meat quota with the EU, so we can expect this to figure in its part in the negotiations, along with beef access – they aren’t major dairy exporters.

Canada, the other major agricultural exporter in the bloc, already has an interim deal with the UK in the form of a rolled over EU deal. Canadian beef producers are particularly anxious to secure better access to the UK market for Canadian beef and to have the hormone barrier to trade removed.

Impact on Ireland

Either through the CPTPP or specific trade deals, it is clear that the UK market for imported agricultural produce is in the process of becoming a more competitive space. In 2020, 80% of UK beef imports came from Ireland and cheddar cheese imports from Ireland have been as high as 90%.

That means enhanced access to the UK market from CPTPP countries will make this market more crowded and with beef price in NZ currently hovering around the equivalent of €3.00/kg, price pressure is inevitable. For UK farmers it will also cause price pressure. Even though UK production will always command top price in the market, any premium will be calculated on a lower starting base price.

Indirect hit as well

As well as more competition in the UK market, Irish farmers are likely to have more competition in EU markets for beef and especially sheepmeat. This is because if the UK market is well supplied with lower-cost beef and sheepmeat, UK farmers will look to export more of their own production to EU markets which they can continue to access on a no-tariff, no-quota basis. This is the same basis on which Irish exports can continue to enter the UK.

Comment

Greater competition in the UK market for agricultural produce is an inevitable consequence of the UK pursuing an independent trade policy.

Granting access to that market is the UK’s biggest negotiating lever when it comes to trade talks and it is a question of when not if this impact is felt by Irish Farmers.

Ireland will always have location convenience and Bord Bia have identified UK consumer sentiment as being pro-Irish when comparing with other imports. Turning this into a monetary value will be the challenge.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: