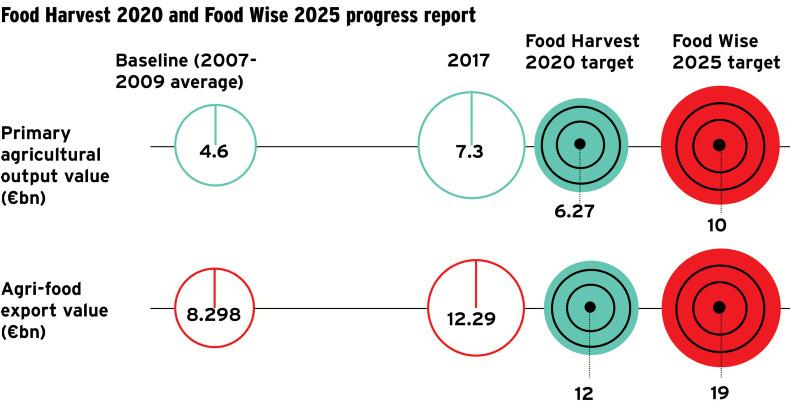

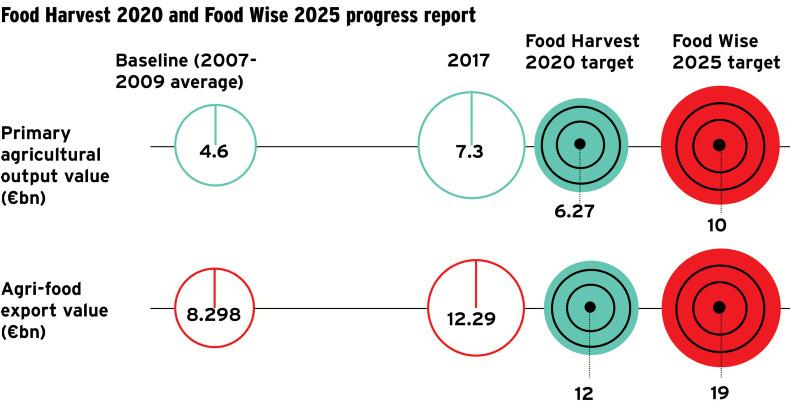

Top-line figures on export value and volume as well as primary production show we have a good way to go if we are to meet the targets set out in Food Wise 2025.

Primary production

Headline targets in terms of primary production were €6.27bn for Food Harvest 2020 and €10bn for Food Wise 2025. In the Government’s Steps to Success update last July, this figure had reached €6.4bn for 2016.

While the Government has yet to publish its latest update, figures from the Central Statistics Office show that agricultural output at basic prices in 2017 was estimated to be €8.3bn.

However, if you subtract the value of forage crops output in 2017 from this, basic agricultural output is €7.3bn.

Milk was the largest contributor to growth, with prices up by 39.2% and volume up by 8.6%. The value of cattle output increased by 6.3% and is estimated at €2.425bn.

This is an increase of €143m over 2016.

Exports

Headline targets for exports were €12bn for Food Harvest 2020 and €19bn for Food Wise 2025. In last year’s Steps to Success update, exports for 2016 stood at €11.2bn. However, figures from Bord Bia show that the value of exports for 2017 surpassed the Food Harvest 2020 target, standing at €12.29bn.

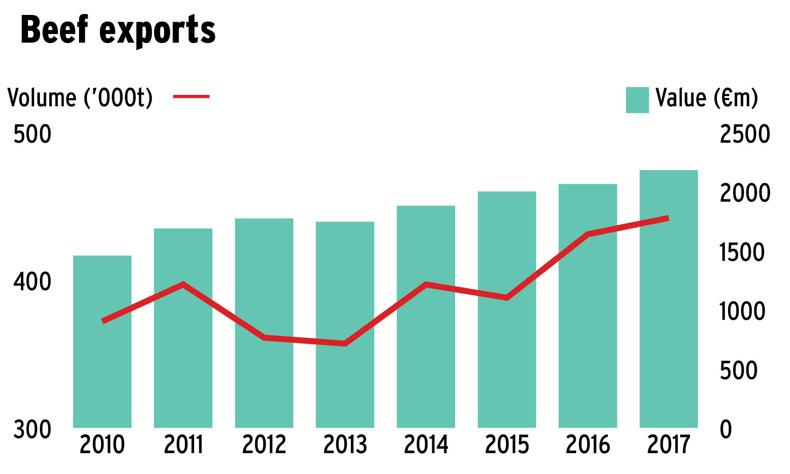

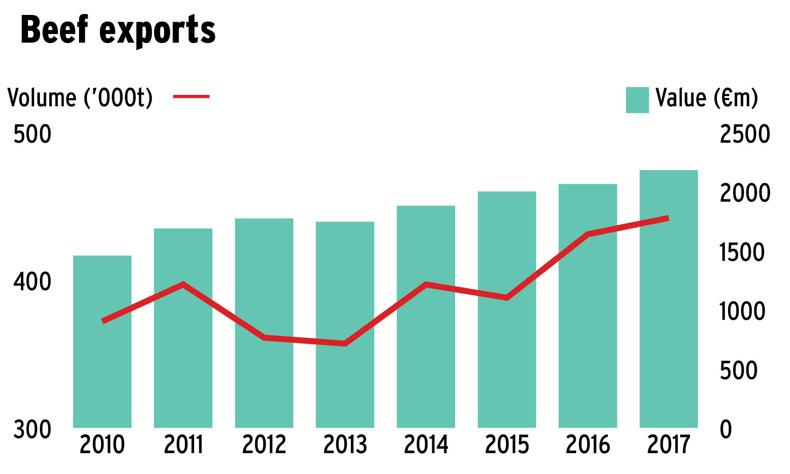

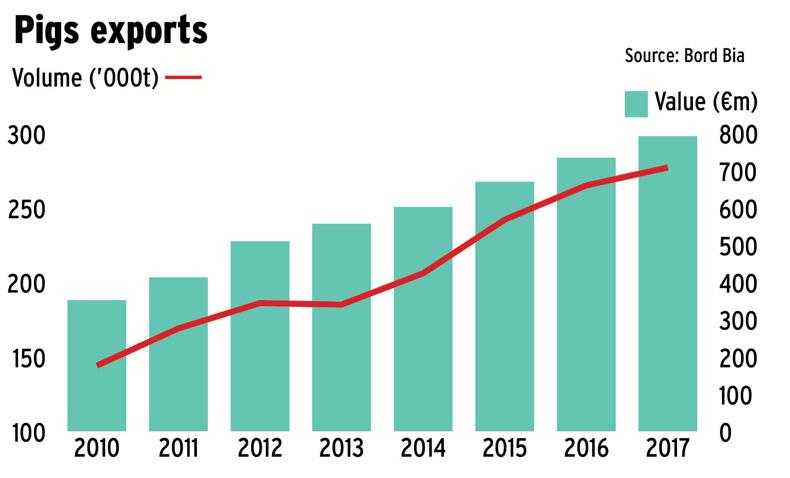

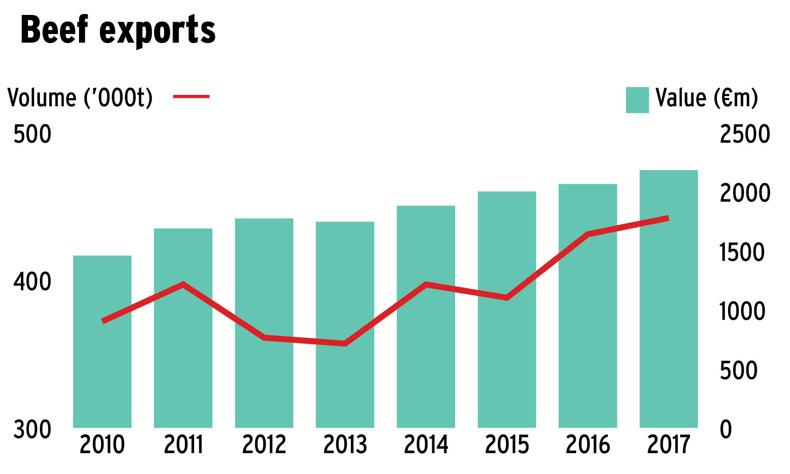

Dairy accounted for 33% of Irish agri food exports in terms of value in 2017. Beef, sheep and pigs accounted for 17%, 3% and 6% respectively.

Growth has been mostly on the value side. While the value of dairy produce exported was 79% higher in 2017 than it was in 2010, the volume of exports has risen by just 32%. Similarly for beef, the value since 2010 is up by 50%, but the volume is up by under 20%.

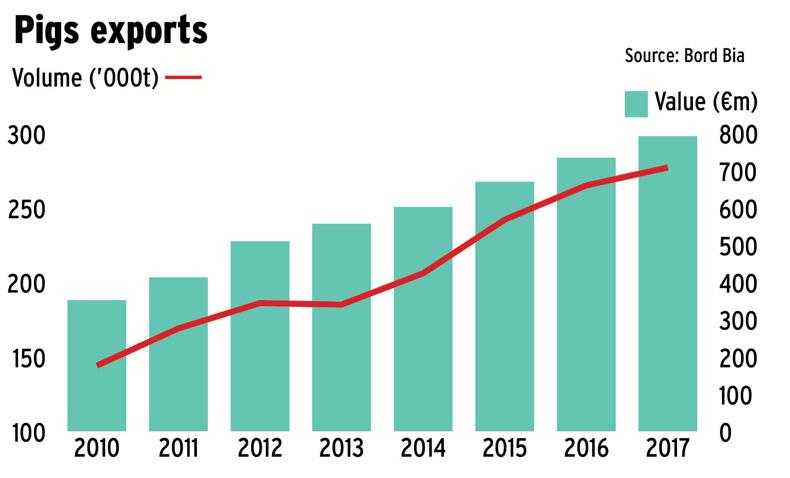

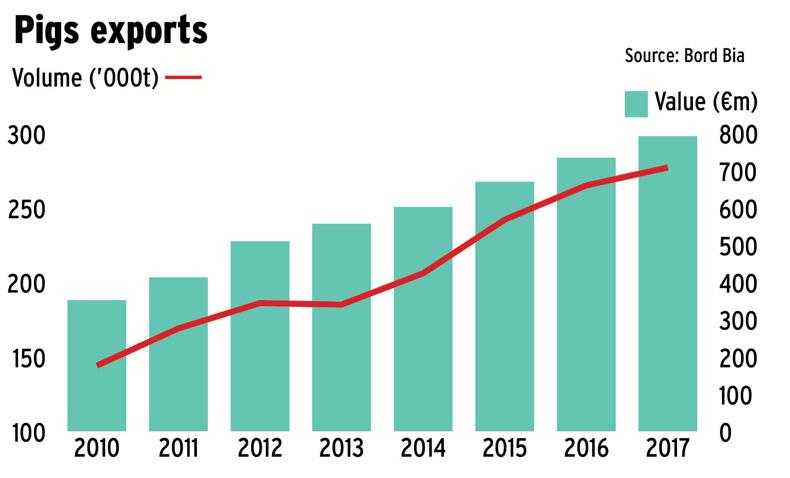

On the sheep side, the value of exports has risen by 91% since 2010, but the volume by 74%. Again for pigs, value is up 125% while volume is up by 92%.

Outside of those four sectors, the biggest percentage volume growth in exports since Food Harvest 2020 was launched has been in seafood (454%) and beverages (436%).

Sector targets

Food Harvest 2020 set out a number of sector targets. The advanced estimate output value figures from the CSO for 2017 show that milk, cattle, pigs and sheep have all passed these targets two years ahead of schedule.

For milk, the target to increase the value of output by 2020 was €2.2bn, 50% more than the baseline 2007 to 2009 average. While the Steps to Success output value for milk was €1.8bn in 2016, the CSO figures for 2017 show that the value of milk output stood at just under €2.5bn last year.

The Food Harvest 2020 target for cattle was a 20% increase to €1.86bn; in 2017, this figure stood at €2.425bn.

For pigs, the target was a 50% increase to €463.5m, the estimate for 2017 was that output would be €520m. The value of sheep output was to increase by 20% to €206.4m, but in 2017 the CSO estimates that this figure was €264.5m.

Read more

‘Not time to fly the white flag’ – Creed commits to Food Wise 2025

Top-line figures on export value and volume as well as primary production show we have a good way to go if we are to meet the targets set out in Food Wise 2025.

Primary production

Headline targets in terms of primary production were €6.27bn for Food Harvest 2020 and €10bn for Food Wise 2025. In the Government’s Steps to Success update last July, this figure had reached €6.4bn for 2016.

While the Government has yet to publish its latest update, figures from the Central Statistics Office show that agricultural output at basic prices in 2017 was estimated to be €8.3bn.

However, if you subtract the value of forage crops output in 2017 from this, basic agricultural output is €7.3bn.

Milk was the largest contributor to growth, with prices up by 39.2% and volume up by 8.6%. The value of cattle output increased by 6.3% and is estimated at €2.425bn.

This is an increase of €143m over 2016.

Exports

Headline targets for exports were €12bn for Food Harvest 2020 and €19bn for Food Wise 2025. In last year’s Steps to Success update, exports for 2016 stood at €11.2bn. However, figures from Bord Bia show that the value of exports for 2017 surpassed the Food Harvest 2020 target, standing at €12.29bn.

Dairy accounted for 33% of Irish agri food exports in terms of value in 2017. Beef, sheep and pigs accounted for 17%, 3% and 6% respectively.

Growth has been mostly on the value side. While the value of dairy produce exported was 79% higher in 2017 than it was in 2010, the volume of exports has risen by just 32%. Similarly for beef, the value since 2010 is up by 50%, but the volume is up by under 20%.

On the sheep side, the value of exports has risen by 91% since 2010, but the volume by 74%. Again for pigs, value is up 125% while volume is up by 92%.

Outside of those four sectors, the biggest percentage volume growth in exports since Food Harvest 2020 was launched has been in seafood (454%) and beverages (436%).

Sector targets

Food Harvest 2020 set out a number of sector targets. The advanced estimate output value figures from the CSO for 2017 show that milk, cattle, pigs and sheep have all passed these targets two years ahead of schedule.

For milk, the target to increase the value of output by 2020 was €2.2bn, 50% more than the baseline 2007 to 2009 average. While the Steps to Success output value for milk was €1.8bn in 2016, the CSO figures for 2017 show that the value of milk output stood at just under €2.5bn last year.

The Food Harvest 2020 target for cattle was a 20% increase to €1.86bn; in 2017, this figure stood at €2.425bn.

For pigs, the target was a 50% increase to €463.5m, the estimate for 2017 was that output would be €520m. The value of sheep output was to increase by 20% to €206.4m, but in 2017 the CSO estimates that this figure was €264.5m.

Read more

‘Not time to fly the white flag’ – Creed commits to Food Wise 2025

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: