All the main buyers of milk in Ireland lifted milk price in August. Hopes are strong despite a slight fall in the Global Dairy Auction this week that milk price will rise further when September prices are set next week.

Our August league table shows what farmers got paid last week and the differences in price between the processors. With the recent price increases, the league has tightened up considerably, with all the big players now in Division two paying €3.30 to €3.40 per kilo milk solids or the equivalent of 23.7 c/litre excluding VAT (25 c/l incl VAT).

Click here for table.

Either side of division two are the west Cork co-ops on top and the northern players on the bottom. Kerry Group didn’t lift milk price for July so they took a big jump for August supplies and it lifted them up into the middle of division two, paying €3.35, which is slightly behind Arrabawn and slightly ahead of Dairygold. Glanbia and Tipperary Co-op are slightly below this again.

LacPatrick, Aurivo and Lakeland are bottom of the league, all paying €3.28 per kilo milk solids. This is 0.28c/kilo milk solids behind the best west Cork has to offer. That’s almost 2c/l in old money which would be about €750 of a difference on August supplies alone.

The average price for the August league table is €3.41 per kilo milk solids (almost 24.25 c/l). However, the main players in the top half of the country are paying the lowest price.

€750 difference in August milk cheque

When we compare the milk prices at the same milk solids there is over €750 of a difference (€12/cow) in the base August milk cheque comparing the west Cork Co-ops and the northern co-ops at the bottom.

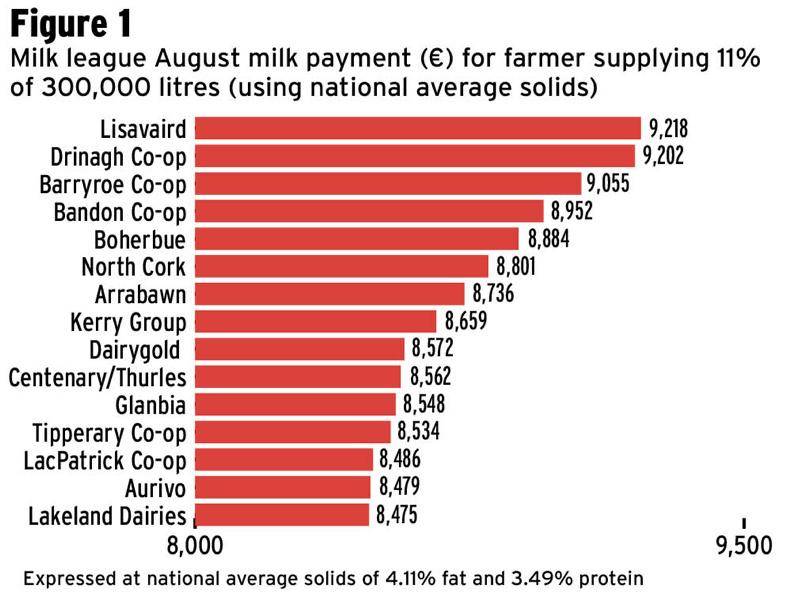

Figure 1 shows the difference in payout between processors for the standardised litre at 3.49% protein and 4.11% fat supplied during the month of August. It shows the difference in the August milk cheque for a supplier with a normal seasonal spring supply curve (11% in August) for a farm that will produce 300,000 litres (66,000 gallons) in the year.

Actual August price

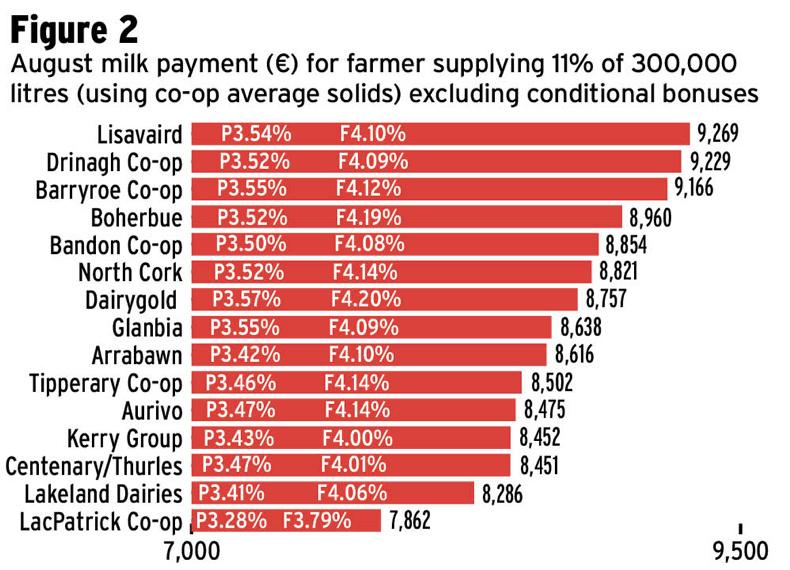

Figure 2 shows the difference in the actual August milk cheque delivered. When I say actual, I mean the money paid out for the different milk solids collected from each of the different processors.

Milk processors collect milk that varies in fat and protein percentage, so in effect the quality of milk goes some way to deciding the milk price paid out. The processor can’t pay top price if the quality is poor. The higher the milk solids (fat and protein), the higher the milk cheque.

Farmers should be rewarded for better milk solids so if a processor is getting less milk solids it will pay a lower price and rightly so as it can make less product from that milk. The combination of good milk price and good milk solids puts Lisavaird top of this graph for August.

Dairygold had the highest combined fat and protein percentages for August at 7.77% while LacPatrick had the worst August milk solids at 7.07%.

The Dairygold value of 7.77% is slightly better than their figure for the same month last year which was 7.70%.

The table shows the international milk league at the same milk solids as our own Monthly League. Emmi, the Swiss Cheese manufacturer, leads the price table paying over 50 c/litre, followed by the US Class III price at 38c/l, which shows why volume is well up in the States.

With plenty of feed around, cheap grain and lots of maize silage to be harvested over there at the moment, they will continue to be big players in terms of supply. The fact they have a large population also means they can soak up large volumes of milk if exports are not going well, which gives them great flexibility.

The three French processors are all paying over 30c/l for August supplies.

The large Dutch processor FrieslandCampina topped up the Hogan 14c/l with another 10c/l as they look to cut national production. My understanding behind the reasoning is that this is an effort to prolong the derogation for nitrogen in Holland. This and impending phosphate law will bring down cow numbers by 2017.

If the Dutch don’t get nitrogen and phosphate back down then they could be forced to reduce production levels by up to 20%.

An underlying problem in FrieslandCampina is processing capacity and last year we saw incentives from Friesland to cut production because they could not process all the milk delivered. Given the number of cows and heifers due to calve next spring, I’d say Friesland are trying to reduce the impact of the oversupply by reducing supply now.

SHARING OPTIONS