Dear Money Mentor, I have been renting 30 acres on conacre for the last 20 years off an elderly neighbour farmer. He is in a nursing home now and has no children. He is still able to make decisions but I normally deal with his nephew each year. I would love to be able to get some more security by renting the land over a longer-term period. I have brought this up with the nephew but he appears to see it easier to keep the status quo. He is working and does not want to farm it. I read all the new tax measures introduced in the budget but really want to know if it will change my situation and make it more attractive for the nephew and farm owner to move into a long-term lease?

Some of the new measures in the Agri Taxation Review are being brought in specifically for the situation in which you find yourself. While you say you have rented the land on conacre, I know that you probably are slow to put in any real investment in improving the land simple because you do not know for certain you will have it the following year. This uncertainty will increase as the owner gets older.

In saying that, the owner could live for years. It does sounds like the landowner is planning to give the farm to his nephew. Let us assume this and that the 30 acres is worth €10,000 an acre. As it stands, if the landowner transferred the land to his nephew now, he would not be eligible for retirement relief. Depending on when he got the land, this could lead to a large capital gains tax (CGT) bill. As the nephew is not working on the farm, he would not get favourite nephew status so his threshold under capital acquisitions tax (CAT) would be €30,150. It would mean he would be exposed to €269,850 at a rate of 33%. This would see the nephew having to pay a CAT bill of €89,051.

He could get agricultural relief that would reduce the value by 90% down to €30,000 and rule him out of any tax bill. However, to get this he would have to pass the farmer test and have 80% of his assets as agricultural on the day he got the land. He would also have to hold on to the land for six years or the relief would be clawed back.

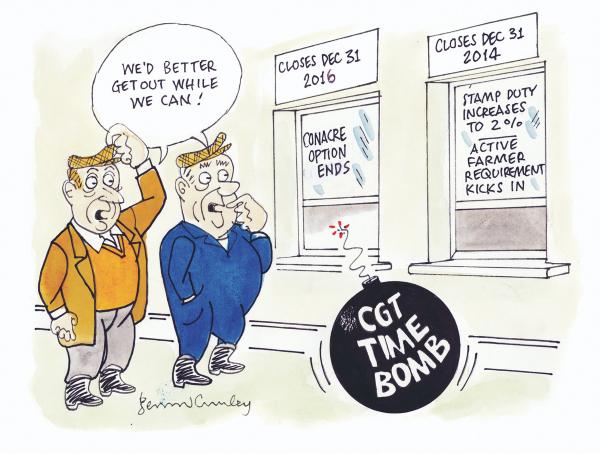

There were two agri measures announced in the budget that are particularly relevant. The first is the measure that allows conacre to be eligible for retirement relief up until the end of 2016. This means that if the owner transferred the land to his nephew or went into a long-term lease before 1 January 2017, he would rule out any CGT bill on the transfer.

The second is that from 1 January 2015, agricultural relief is going to be targeted and you have to be an active farmer, be a young qualified farmer or move into a long-term lease to get it.

As the nephew does not plan to farm, he would have to move into a long-term lease or face a large tax bill. He has to hold the land for six years anyway, so it makes sense.

The other element to consider is that as the landowner is in a nursing home, under the Fair Deal Scheme his assets are taken into account for payment. It means that if there is no money to pay the fees, the nursing home will take a charge of 5% a year on the land on which there is no cap anymore. The value of the asset to hand on to his nephew will be reducing and he might be forced to sell it when he actually gets the land to pay off the accumulated nursing home fees.

The decision in the end is the landowner’s. However, as he is still in sound mind, these options should be laid out for him. By transferring before 31 December 2014, he would avoid the nephew having to be an active farmer. The new tax measure making conacre eligible would mean he would qualify for retirement tax relief.

At the very least he should move into a long-term lease by the end of 2016 to lock in that benefit. Even if he decides not to transfer the land in his lifetime, the nephew will have to go into a long-term lease to get agriculture relief to cut his potential tax bill from nearly €90,000 to zero.

You should contact the nephew now and make him aware of this. Get him to go to a good tax accountant who understands farming to set out the options available to him as they are now very different than they were before the budget.

SHARING OPTIONS