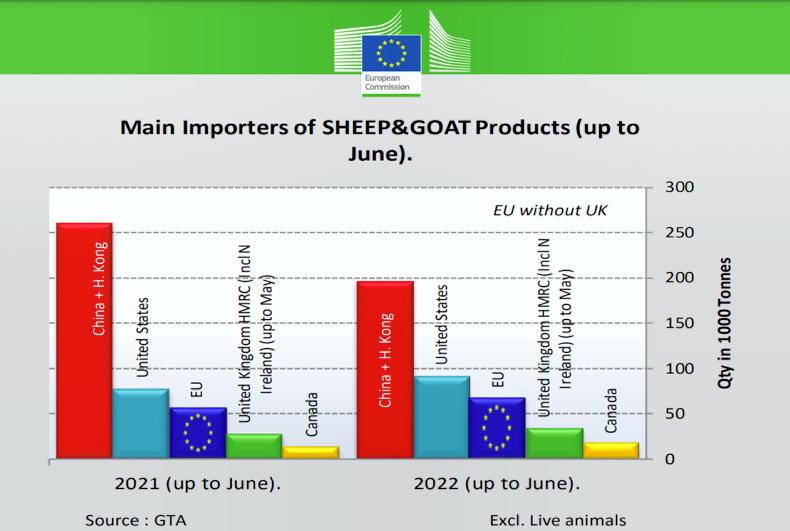

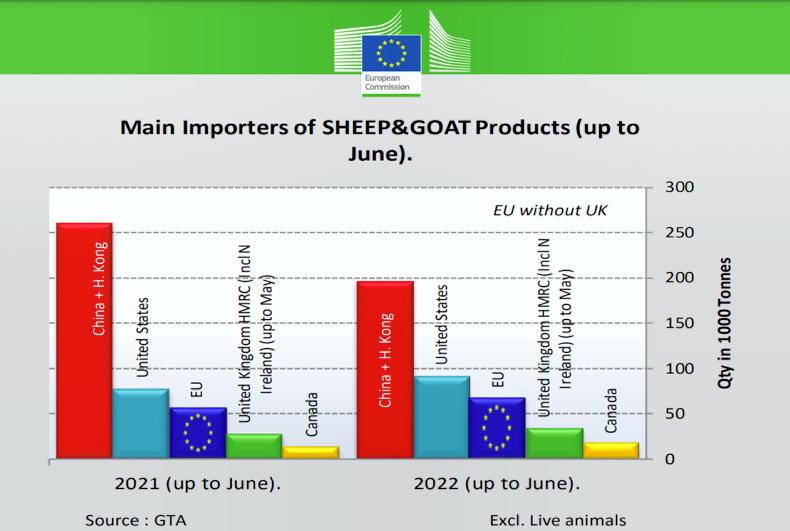

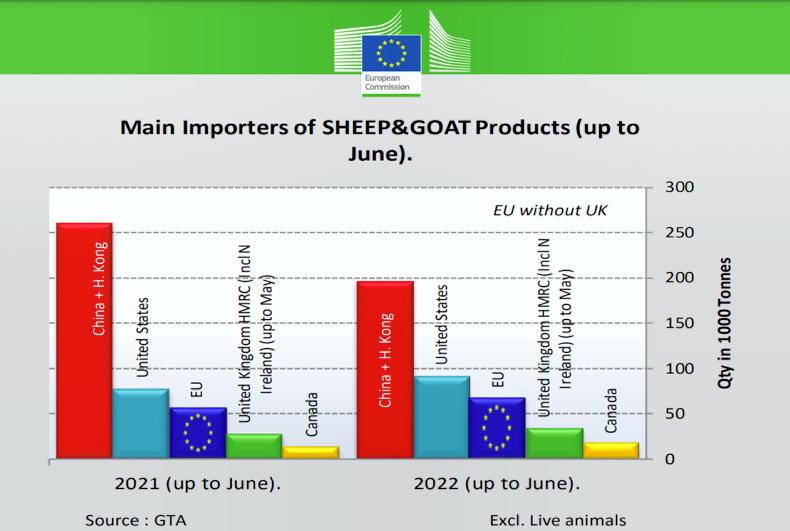

The latest market analysis published by the European Commission shows imports of sheepmeat by China and Hong Kong for the first half of 2022 reducing by about 60,000t, or over 20%, on the corresponding period in 2021.

Sheepmeat imports are not the only product under pressure, with imports of dairy products also reported as running 22% lower year on year.

The reduction in imports is being attributed mainly to prolonged lockdowns due to COVID-19 outbreaks.

The reduction in imports is witnessing New Zealand and Australia, which are the main suppliers of sheepmeat to the Chinese market, divert higher volumes to alternative markets such as the US.

EU imports

This includes an increase in the volume of sheepmeat destined for the EU market.

Import volumes for the first six months of the year have been recorded at 41,745t, an increase of 7,466t, or 22% on 2021 levels.

The greatest change was in New Zealand, where import volumes of 33,780t are running 4,690t or 16% higher year on year.

While volumes have increased, they are still running lower than traditional volumes, but it still serves as a warning signal that if Chinese consumption comes under further pressure for any reason, it could lead to higher volumes destined for the EU and UK.

Sheepmeat imports in China are running in the region of 60,000t lower year on year.

Imports from Australia jumped, but from a low base, with the 3,150t imported up 1,828t year on year.

Imports from North Macedonia are unchanged at 2,009t, while imports from Argentina at 973t are 24% or 188t higher.

Imports from Chile at 921t have more than doubled from 435t in 2021, while imports from Uruguay also jumped from just 15t in 2021 to 304t in 2022.

The latest market analysis published by the European Commission shows imports of sheepmeat by China and Hong Kong for the first half of 2022 reducing by about 60,000t, or over 20%, on the corresponding period in 2021.

Sheepmeat imports are not the only product under pressure, with imports of dairy products also reported as running 22% lower year on year.

The reduction in imports is being attributed mainly to prolonged lockdowns due to COVID-19 outbreaks.

The reduction in imports is witnessing New Zealand and Australia, which are the main suppliers of sheepmeat to the Chinese market, divert higher volumes to alternative markets such as the US.

EU imports

This includes an increase in the volume of sheepmeat destined for the EU market.

Import volumes for the first six months of the year have been recorded at 41,745t, an increase of 7,466t, or 22% on 2021 levels.

The greatest change was in New Zealand, where import volumes of 33,780t are running 4,690t or 16% higher year on year.

While volumes have increased, they are still running lower than traditional volumes, but it still serves as a warning signal that if Chinese consumption comes under further pressure for any reason, it could lead to higher volumes destined for the EU and UK.

Sheepmeat imports in China are running in the region of 60,000t lower year on year.

Imports from Australia jumped, but from a low base, with the 3,150t imported up 1,828t year on year.

Imports from North Macedonia are unchanged at 2,009t, while imports from Argentina at 973t are 24% or 188t higher.

Imports from Chile at 921t have more than doubled from 435t in 2021, while imports from Uruguay also jumped from just 15t in 2021 to 304t in 2022.

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: