The inclusion of an unconditional January 3c/litre bonus pushes LacPatrick (formerly Town of Monaghan & Ballyrashane) to the top of the January milk league. The January milk statement arrived to most dairy farmers recently and for many it confirmed more good news, with January milk prices up on average by 0.14c/kg milk solids or 1c/l in old money for most co-ops. Kerry and North Cork had a bit of ground to make up on the rest so they actually raised January price by 2c/l and 1.5c/l respectively. Both were wedged at the bottom of the December league, so they had little choice but to pull up their socks for January supplies.

The inclusion of an unconditional January 3c/litre bonus pushes LacPatrick (formerly Town of Monaghan & Ballyrashane) to the top of the January milk league. The January milk statement arrived to most dairy farmers recently and for many it confirmed more good news, with January milk prices up on average by 0.14c/kg milk solids or 1c/l in old money for most co-ops.

Kerry and North Cork had a bit of ground to make up on the rest so they actually raised January price by 2c/l and 1.5c/l respectively. Both were wedged at the bottom of the December league, so they had little choice but to pull up their socks for January supplies.

The west Cork co-ops held base price for January, but remember they have been at the top of the league all during 2016, so they are still among the best payers despite not increasing January 2017 price.

All the big players – Dairygold, Lakeland, Aurivo, Arrabawn, and Glanbia – went up 0.14c/kg MS (1c/l) for January supplies.

Average January price

The average Irish price ex VAT for the January monthly milk league is €4.14/kg MS at national average milk solids. The average price at 3.3% protein and 3.6% fat is 29.6c/l ex VAT. All prices are quoted ex VAT and excluding SDAS bonuses and conditional bonuses such as cell count bonuses, etc.

€189 difference in

January milk cheque

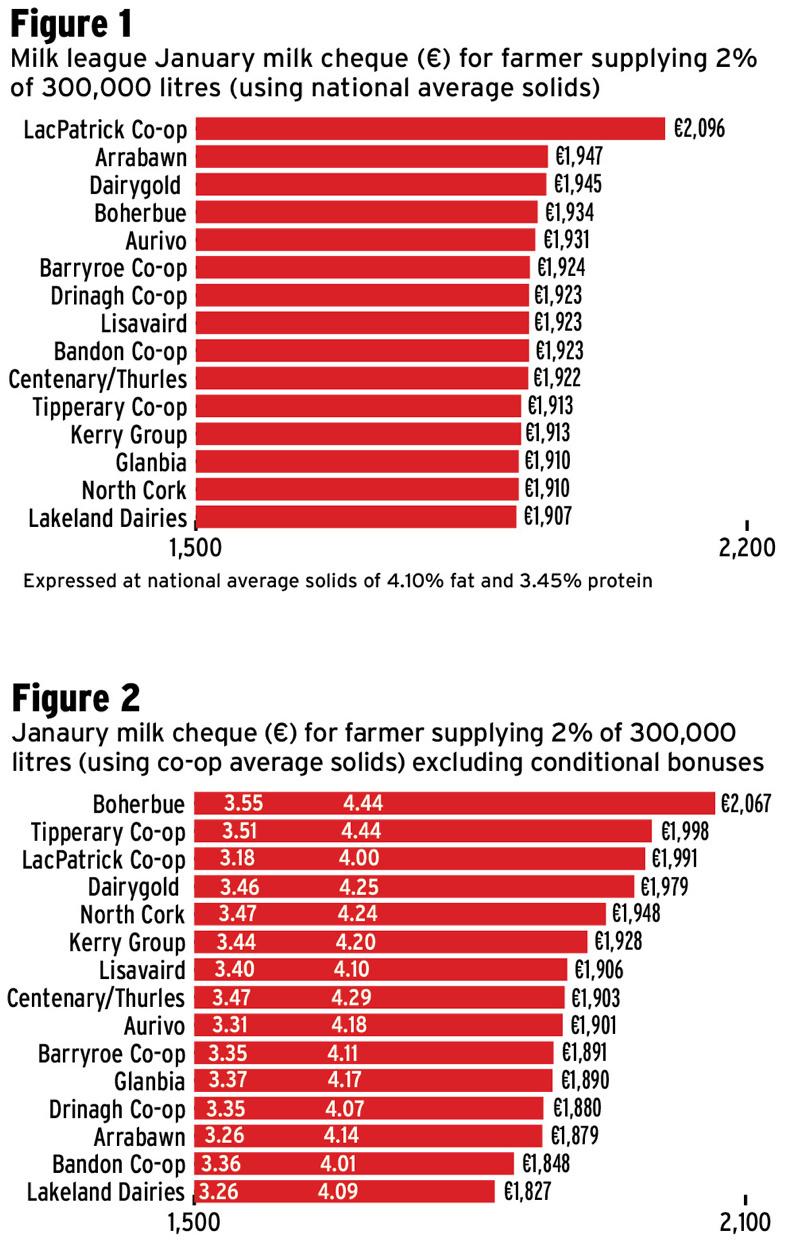

As supply is so small, when we compare the milk prices at the same milk solids (national average), there is only €189 of a difference in the base January milk cheque.

Figure 1 shows the difference in payout between processors for the standardised litre at 3.45% protein and 4.10% fat supplied during the month of January. It shows the difference in the January milk cheque for a supplier with a normal seasonal spring supply curve (2% in January) for a farm that will produce 300,000 litres (66,000 gallons) in the year.

Actual January price

paid out

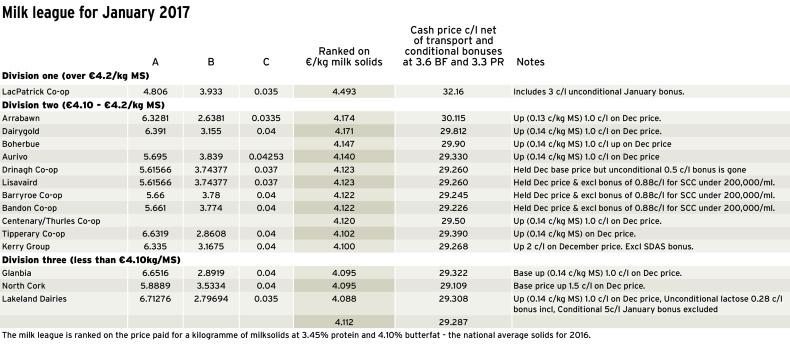

Figure 2 shows the difference in the actual December milk cheque delivered. When I say actual, I mean the money paid out for the different milk solids collected from each of the different processors.

Milk processors collect milk that varies in fat and protein percentage, so in effect the quality of milk goes some way to deciding the milk price paid out. The processor can’t pay top price if the quality is poor. The higher the milk solids (fat and protein), the higher the milk cheque.

Farmers should be rewarded for better milk solids, so if a processor is getting less milk solids it will pay a lower price and rightly so as it can make less product from that milk. The combination of good milk price and good milk solids puts the small north Cork co-op Boherbue top of this graph for January followed by Tipperary, who also had good solids for January. There is €240 of a difference between top and bottom.

January milk supplies down

January milk supplies were back compared with January 2016. CSO estimates that January supplies were back 4.6% for the month. Remember of course that January supplies are relatively small anyway, about 2% of the annual supplies, so it won’t make that much difference in the bigger scheme of things. The CSO estimates monthly domestic deliveries at about 140m litres, down from about 147m litres in Janaury 2016.

Why is this? Some of the processors were doing handstands wondering why January and early February supplies were back compared to last year. From listening to farmers, the two big reasons are they purposefully pushed calving date a week later and many larger-scale farmers are on once-a-day for the first two to three weeks of milking so it gives them a chance on the labour front to keep the jobs completed. Weather and level of feeding is also going to impact. I don’t think there is any other significant reason.

Butter value

In the UK, there was much talk among traders that the butter market was on the way down but in the last two weeks that market has actually rallied. Dutch butter was recently back over €4,000. Strong export demand for fat from the EU (EU best value gloabally now) and relatively low butter stocks are the main drivers behind the rise. The cheese and skim market in the UK is weaker.

In terms of milk, spot price in the UK is stable at 26 to 28p/litre. UK Arla Foods was the only real mover, recently raising its price by 0.5c from March to 27.44 pence/litre. The rest more or less held price. The official January milk price is 27.13p/l, up almost 1p/l on December (similar to Irish movements).

GDT down

On the international milk price front, the 3.2% price fall in the GDT index last week was the sharpest since 3 January, when prices fell by 3.9%. There had been small increases in the two intervening auctions. Milk powders were back by between 3.8% (SMP) and 3.7% (WMP). The prices of cheddar and casein fell by more than 5% while butter held its own. The slightly negative price shift was expected on the back of milk supply news that Fonterra collections are not as bad as predicted.

Murray Goulburn

Australia’s largest milk processor Murray Goulburn posted a AUS$31.9m loss in its most recent half year results. The big driver of this was milk supplies had fallen by over 20% as farmers left the company. Shares in the company have fallen from $2.56 in December 2015 to just about 90 cents recently. The whole Australian dairy industry is in chaos at the moment.

US milk supply

January supply in the US rose by 2.7% as cow numbers increased compared with January 2016. The USDA states that 17bn pounds of milk was produced in January 2017. Production per cow increased and there were 67,000 extra cows on US farms.

2016 figures show annual US milk production was up 1.8% for 2016 compared with 2015 – as good feed stocks and relatively good milk prices continue to deliver for US farmers.

Read more

NI milk league: winter bonus puts Aurivo on top for January

NI milk league: 12-month average milk price still rising

SHARING OPTIONS: