With over 90% of Irish beef industry output exported in 2015, understanding the competitive position of the Irish beef industry is of obvious importance. The majority of Irish beef exports are to EU markets but with the prospect of Brexit and possible future free trade agreements, comparisons with producers in non-EU countries is increasingly important.

The agri benchmark network collects and publishes data on the costs and returns from beef production at the farm level for typical beef farms from around the world. This article summarises the key research findings of the agri benchmark Beef and Sheep Network for 2015 contained in the recently published agri benchmark report. Teagasc is the Irish partner in this international network and provides data on typical Irish beef and sheep farms based on information collected in the Teagasc National Farm Survey (NFS).

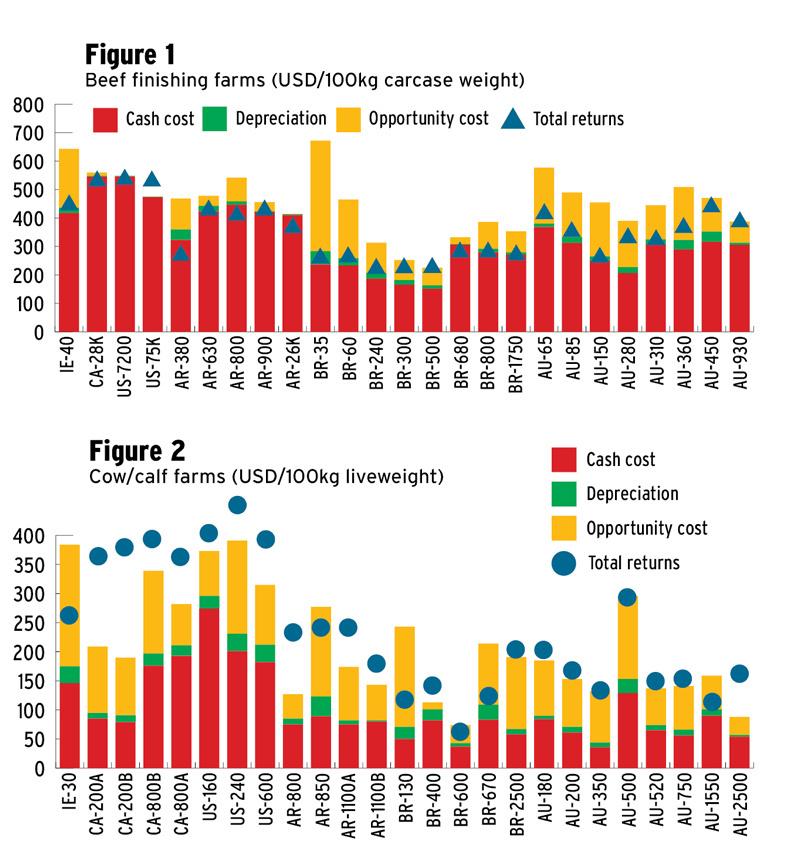

This article places the typical Irish beef farming system into a global context by focusing on how two typical Irish beef farms compare internationally in terms of costs of production and returns with typical beef farms in other countries. For the purposes of the exercise the typical Irish beef finisher has 40 finishers, while the typical Irish cow-calf (single suckling) farm has 30 beef cows. The annual agri benchmark comparison of typical farms from around the world has been on-going since 1997. Data is collected using standardised methods so as to deliver reliable and comparable results.

Among the many challenges in producing international cost and profitability comparisons is to provide them in a common currency. In all agri benchmark reports, costs and revenues are reported in US dollars (USD). Since the value of other currencies against the USD changes through time (and to differing degrees) this has an unavoidable impact on the comparison results.

Readers should be mindful that averages often conceal a lot of diversity in farm scales across the world. On the one hand there are countries where typically there are only two or three livestock per farm, while on the other hand in some countries typical farms are feedlots, which are much bigger operations with up to and over 6,000 finishers per farm. In the figures presented in this article, the number beside each farm indicates the number of livestock, on average, that are present on the farm. (IE 40 - Irish farm with 40 finishers)

Irish farms in context

Ireland exports close to 90 percent of its beef production and is the fifth-largest net exporter of beef in the world (CSO 2016c, USDA 2016). Supply developments in Ireland can cause Irish cattle prices to deviate from export market prices over the short run, but it is conditions in markets to which Irish beef and cattle are exported that largely determine Irish cattle prices.

Global beef production and costs – the outlook

Global production and exports of beef are both expected to increase in 2017 (USDA, 2016). The forecast increase in meat production is largely driven by developments in the US and Brazil, where the recent breeding herd rebuilding phase is now being reflected in increased meat production. Ongoing stock rebuilding in Australia, following the breaking of the recent drought, will in the short term reduce Australian beef production and exports and help limit the degree to which growing US and South American production depresses world beef prices in 2017. Nevertheless, with ongoing slow economic growth globally, world beef prices are likely to fall in 2017 as compared with 2016.

Beef: cost, returns and profitability and their developments

When measuring competitiveness it is vital that costs are not just measured in isolation but that returns are also examined. The agri benchmark data on beef production costs and returns shows that, with few exceptions, beef finishing enterprises around the world have low levels of profitability. It must be borne in mind that returns from other on-farm enterprises and decoupled payments can compensate for losses in beef finishing enterprises, providing a positive income outcome at the whole-farm level.

The key international finding is that in general, total enterprise returns do not cover total economic costs across the majority of the farms.

Irish cash costs of production are relatively low when compared with other EU countries and the agri benchmark data indicate that returns generally exceed cash costs – equivalent to positive gross margin territory. Irish cash costs are lower than US and Canadian costs. IE-40 total returns are, however, also lower than the returns on typical US and Canadian finishing farms. However, it should be highlighted that the typical US and Canadian farms are of a much greater scale than a typical Irish or European farm – 75,000 and 28,000 head respectively. This much greater scale of physical production allows these farms to survive on very low margins per 100kg carcase weight.

Ireland’s beef finishing competition on the global stage

The main countries which Ireland and EU beef competes with on the global stage are Australia, United States of America, Canada, Argentina and Brazil.

Figure 1 compares the Irish beef finishing farm (IE-40) costs of production, opportunity costs and total returns (USD per 100kg carcase weight) for all the above countries.

The total returns of the Irish beef finishing farm are on a par with those earned on Argentinean and Australian farms, and well above the average for the eight typical Brazilian farms as shown in Figure 1.

In terms of Irish farm competiveness, the Irish farm is quite similar to a number of the Australian typical farms in that total returns cover (or almost cover) cash costs but fail to cover any of the opportunity costs. On the US-75k farm, total returns cover total economic costs.

While on other US and Canadian typical farms, total returns fall just short of total economic costs.

Irish farm costs of production, which include cash costs and depreciation,are higher than costs on Brazilian, Argentinian and Australian farms. Opportunity costs, and consequently the total economic costs, are much higher than the average for typical farms from Brazil, Argentina and Australia.

The typical Irish farm’s total returns just about cover the cash costs, but do not cover any of the opportunity costs for own land and labour. In terms of Irish beef farming’s long-term viability and competitiveness, this is a worrying outcome – economic returns fall well short of total economic costs.

Irish cow calf farms in context

In an Irish context, the calf/weaner output from cow-calf farms provides the most important input into the beef finishing enterprise. Returns to cow-calf farms are largely determined further along the supply chain.

In this regard, it is important to compare the typical Irish cow-calf farm (IE-30) with its main international competitors. The countries included in Figure 2 are Canada, US, Argentina, Brazil and Australia.

The Irish farm cash costs are higher than those in these competing countries (apart from one of like sized Brazil farm BR-35). The opportunity costs, and consequently the total economic costs, are generally higher than in the other countries’ typical cow-calf farms. The total returns of the Irish cow-calf farm are on a par with the Argentinean typical farm, but are lower than the level achieved by the typical US and Canadian farms. Returns on the typical Irish farm are higher than on all the Brazilian typical farms and on the majority of typical Australian cow-calf farms, but Irish costs are also higher.

These results indicate that the typical Irish cow-calf farm is not competitive internationally. When total economic costs are compared with total revenues from production, the typical Irish cow-calf farm is one of the worst performing farms when assessed on the basis of total economic profit per 100kg liveweight produced.

The higher costs of production in Ireland are not being offset by sufficiently greater returns per 100kg liveweight. Irish farmers have lower cash costs than some north American cow-calf farms but the returns from these north American farms in general are superior to those on the typical Irish farm.

When opportunity costs are accounted for and total economic costs of production are compared, the longer-term competitiveness of Irish farms is inferior to that of most North and South American farms.

This highlights again the international competitiveness challenge faced by typically sized Irish cow calf and beef finishing farms.

Typical farms – the principle: A typical farm represents the most common production system in a country or a region. For each country, farms selected are located in important production regions, using the prevailing combination of land, labour and capital and common technologies, running the prevailing production system, and having not too big or too small a size. The typical farms are selected and validated by reference to accounting statistics and panels of experts in each participating country. This methodology is applicable in countries without or limited statistics/accounting figures and is applicable on a global scale.

Costs of production include all costs from the profit & loss account of the farm, including depreciation. The opportunity costs for own labour, land and capital are included. Importantly, the scope of this cost definition extends beyond the typical production cost definition that is often cited with reference to Ireland and other EU member states.

Agri benchmark is a global network of researchers, representing 149 beef farms internationally in the cow calf and beef finishing systems. This network is independent from third parties and participation in the network provides access to a reliable international database, containing farm and agricultural sector data for all participant countries, data that is harmonised so as to facilitate cross country comparisons. The main research focus of the agri benchmark network and its core competence is in the field of beef production, beef prices and farm economics. Further details: www.agribenchmark.org. Teagasc is the supplier of Irish data to the agri benchmark network for cow-calf, beef finishing and sheep farms.

SHARING OPTIONS