Historically, France and the UK were the main destinations for Irish sheepmeat exports. In 2009, these two markets accounted for almost 80% of Irish sheepmeat exports. However, by 2018, it is estimated they will command a 55% volume share.

The real drivers of growth, both in value and volume terms, have been achieved across a number of key European markets including Belgium, Denmark, Germany, Sweden and Switzerland. In 2008, these markets accounted for an 11% share of volume exports. Today, they account for almost one-third of our sheepmeat exports.

Our success in continental Europe came at a time when New Zealand was putting less emphasis on Europe. This was largely due to fact the Europe was in a recession and its focus shifted toward the more attractive markets of China and the US.

As outlined in Figure 1, New Zealand quota utilisation has fallen from a high of 98% a decade ago, to an estimated 54% usage in 2019. This reduction in quota utilisation is equivalent to 98,000t carcase weight equivalent (cwe) of New Zealand sheepmeat being traded into the EU.

This year, for the first time, New Zealand will export more sheepmeat to China than the EU and Ireland has been increasingly filling the gaps left behind in the EU.

Shifting from carcase to cuts

With over 120 years’ experience of exporting sheepmeat into Europe, the New Zealanders are pioneers of product innovation.

A key feature of their export success has been built on breaking down the carcase and seeking the best-paying customers for the high- and low-value cuts.

In 1990, 47% of New Zealand sheepmeat exports were as carcase, with the balance in cuts.

Thirty years later, New Zealand has re-engineered its offer, where 98% of its sheepmeat exports is sold as cuts, with the balance as carcase.

In many ways, Ireland has become the New Zealand of northern Europe. The decision by the Irish industry to diversify from trading carcases in the commodity-driven markets of France and the UK was the right choice.

As an industry, we have broadened our view of the world and become more customer-orientated.

With 70% of Irish sheepmeat exports shipped as cuts/primals, our business is about attention to detail, delivering specific cuts for the discerning needs of customers across retail, foodservice and manufacturing.

Access to 500m consumers

Trading within the EU has given the Irish sheepmeat industry access to over 500m consumers as part of our home market that consumes more sheepmeat than it produces.

The absence of trade barriers, the harmonisation of standards and a single currency has brought efficiencies and commercial opportunities to the Irish sheep sector.

Furthermore, it has enhanced our competitiveness at a global level. Ireland is the fourth largest sheepmeat exporter in the world and the second largest net exporter of sheepmeat in the EU.

Market access

Having full and free access to a wide range of international markets will future-proof the Irish sheepmeat industry and ensure we are not overly reliant on any one target market or region.

Japan is one such market and a long approval process concluded earlier this year on a ministerial visit to Japan, marking the culmination of several years’ work by the market access team in the Department of Agriculture, Food and the Marine and Bord Bia.

The decision to grant sheepmeat access represented a powerful endorsement of Ireland’s high standards in farming and industry as food safety and traceability are prerequisites for trade Japan. As one of the world’s largest meat importers, Japan offers a significant growth potential for Irish sheepmeat. However, from past experiences of establishing Irish pork and beef exports into Japan, it will take time before we see significant volumes of Irish sheepmeat heading to this market.

The Japanese business culture attaches a high degree of importance to establishing personal relationships and trust.

For that reason, Ireland – through the support of EU co-funding – has been promoting European beef and lamb across Japan, China and Hong Kong over the last three years.

In addition to this, the opening up of a new Bord Bia office in Tokyo and, separately, the appointment of an agriculture attaché underlines the strategic importance of this market.

Canada

In 2013, Ireland secured market access for sheepmeat into the Canadian market which is expected to take 1,500t of Irish sheepmeat this year, a 19% growth on last year’s exports of sheepmeat to Canada. The market is mainly focused on frozen, boneless cuts of mutton.

China and the US – opportunities

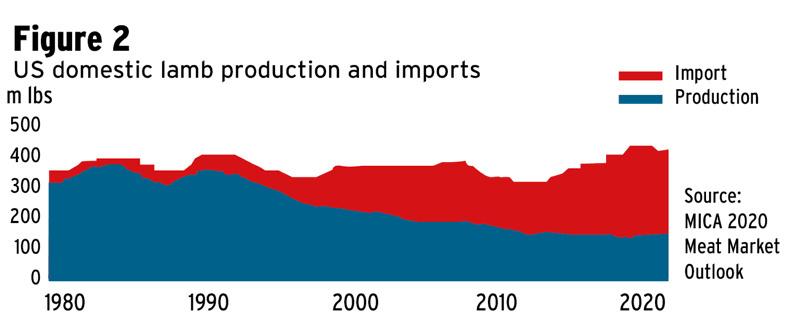

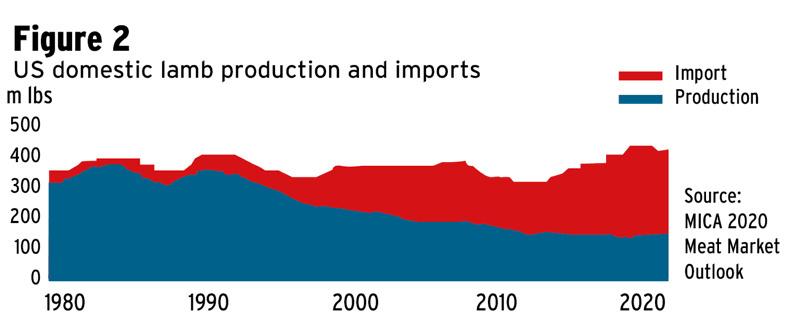

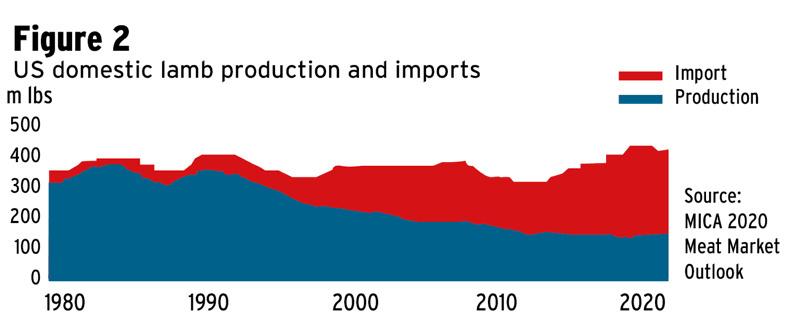

As outlined in Figure 2, sheepmeat production in the US has been steadily declining over the last 40 years.

Nevertheless, a growing demand for mutton and lamb within the respective ethnic and foodservice sectors has fuelled a strong import trade, which accounts for almost two-thirds of the market. In 2018, the US imported 124,873t, which was a 20% increase on 2016 levels.

Working in close collaboration with Department of Agriculture, Food and the Marine, the US will be a top priority for Bord Bia. A key issue to securing access will be the lifting of their TSE rule banning EU sheepmeat.

While China is 95% self-sufficient in sheepmeat production, the scale of the import opportunities is magnified by its 1.4bn consumers.

Import demand has been growing in double digits largely due to a surge in higher income consumers, migration to tier one cities and a shift towards a protein-rich diet.

The outbreak of African swine fever (ASF) has created an insatiable demand for alternative meats such as beef and lamb.

Chinese sheepmeat imports for 2019 are set to reach a record highs and likely to surpass 370,000t, up from 319,000t in 2018 (Table 1).

Building on the back of an official Chinese inspection visit of Irish sheepmeat plants in August/September and a recent bi-lateral meeting between Minister for Agriculture Michael Creed and the Minister of the General Administration of Customs China (GACC), there is a strong sense that Ireland will secure market access for sheepmeat in the coming year.

Securing market access to China and the US would help to underpin a better and more balanced price return to the Irish farmer and exporter, particularly during peak periods of production.

Historically, France and the UK were the main destinations for Irish sheepmeat exports. In 2009, these two markets accounted for almost 80% of Irish sheepmeat exports. However, by 2018, it is estimated they will command a 55% volume share.

The real drivers of growth, both in value and volume terms, have been achieved across a number of key European markets including Belgium, Denmark, Germany, Sweden and Switzerland. In 2008, these markets accounted for an 11% share of volume exports. Today, they account for almost one-third of our sheepmeat exports.

Our success in continental Europe came at a time when New Zealand was putting less emphasis on Europe. This was largely due to fact the Europe was in a recession and its focus shifted toward the more attractive markets of China and the US.

As outlined in Figure 1, New Zealand quota utilisation has fallen from a high of 98% a decade ago, to an estimated 54% usage in 2019. This reduction in quota utilisation is equivalent to 98,000t carcase weight equivalent (cwe) of New Zealand sheepmeat being traded into the EU.

This year, for the first time, New Zealand will export more sheepmeat to China than the EU and Ireland has been increasingly filling the gaps left behind in the EU.

Shifting from carcase to cuts

With over 120 years’ experience of exporting sheepmeat into Europe, the New Zealanders are pioneers of product innovation.

A key feature of their export success has been built on breaking down the carcase and seeking the best-paying customers for the high- and low-value cuts.

In 1990, 47% of New Zealand sheepmeat exports were as carcase, with the balance in cuts.

Thirty years later, New Zealand has re-engineered its offer, where 98% of its sheepmeat exports is sold as cuts, with the balance as carcase.

In many ways, Ireland has become the New Zealand of northern Europe. The decision by the Irish industry to diversify from trading carcases in the commodity-driven markets of France and the UK was the right choice.

As an industry, we have broadened our view of the world and become more customer-orientated.

With 70% of Irish sheepmeat exports shipped as cuts/primals, our business is about attention to detail, delivering specific cuts for the discerning needs of customers across retail, foodservice and manufacturing.

Access to 500m consumers

Trading within the EU has given the Irish sheepmeat industry access to over 500m consumers as part of our home market that consumes more sheepmeat than it produces.

The absence of trade barriers, the harmonisation of standards and a single currency has brought efficiencies and commercial opportunities to the Irish sheep sector.

Furthermore, it has enhanced our competitiveness at a global level. Ireland is the fourth largest sheepmeat exporter in the world and the second largest net exporter of sheepmeat in the EU.

Market access

Having full and free access to a wide range of international markets will future-proof the Irish sheepmeat industry and ensure we are not overly reliant on any one target market or region.

Japan is one such market and a long approval process concluded earlier this year on a ministerial visit to Japan, marking the culmination of several years’ work by the market access team in the Department of Agriculture, Food and the Marine and Bord Bia.

The decision to grant sheepmeat access represented a powerful endorsement of Ireland’s high standards in farming and industry as food safety and traceability are prerequisites for trade Japan. As one of the world’s largest meat importers, Japan offers a significant growth potential for Irish sheepmeat. However, from past experiences of establishing Irish pork and beef exports into Japan, it will take time before we see significant volumes of Irish sheepmeat heading to this market.

The Japanese business culture attaches a high degree of importance to establishing personal relationships and trust.

For that reason, Ireland – through the support of EU co-funding – has been promoting European beef and lamb across Japan, China and Hong Kong over the last three years.

In addition to this, the opening up of a new Bord Bia office in Tokyo and, separately, the appointment of an agriculture attaché underlines the strategic importance of this market.

Canada

In 2013, Ireland secured market access for sheepmeat into the Canadian market which is expected to take 1,500t of Irish sheepmeat this year, a 19% growth on last year’s exports of sheepmeat to Canada. The market is mainly focused on frozen, boneless cuts of mutton.

China and the US – opportunities

As outlined in Figure 2, sheepmeat production in the US has been steadily declining over the last 40 years.

Nevertheless, a growing demand for mutton and lamb within the respective ethnic and foodservice sectors has fuelled a strong import trade, which accounts for almost two-thirds of the market. In 2018, the US imported 124,873t, which was a 20% increase on 2016 levels.

Working in close collaboration with Department of Agriculture, Food and the Marine, the US will be a top priority for Bord Bia. A key issue to securing access will be the lifting of their TSE rule banning EU sheepmeat.

While China is 95% self-sufficient in sheepmeat production, the scale of the import opportunities is magnified by its 1.4bn consumers.

Import demand has been growing in double digits largely due to a surge in higher income consumers, migration to tier one cities and a shift towards a protein-rich diet.

The outbreak of African swine fever (ASF) has created an insatiable demand for alternative meats such as beef and lamb.

Chinese sheepmeat imports for 2019 are set to reach a record highs and likely to surpass 370,000t, up from 319,000t in 2018 (Table 1).

Building on the back of an official Chinese inspection visit of Irish sheepmeat plants in August/September and a recent bi-lateral meeting between Minister for Agriculture Michael Creed and the Minister of the General Administration of Customs China (GACC), there is a strong sense that Ireland will secure market access for sheepmeat in the coming year.

Securing market access to China and the US would help to underpin a better and more balanced price return to the Irish farmer and exporter, particularly during peak periods of production.

SHARING OPTIONS