The report from Argentina at the weekend that they were pulling out of Mercosur trade negotiations on deals not yet completed reflects the change of political outlook since the election of President Alberto Fernández late last year. He replaced the more free market orientated Mauricio Macri who was elected in 2015 bringing to an end 10 years of socialist government. It was during his term that Argentina re-emerged as a serious exporter of beef, increasing from 209,000t in 2019 to a predicted 840,000t this year (USDA, carcase weight equivalent – CWE).

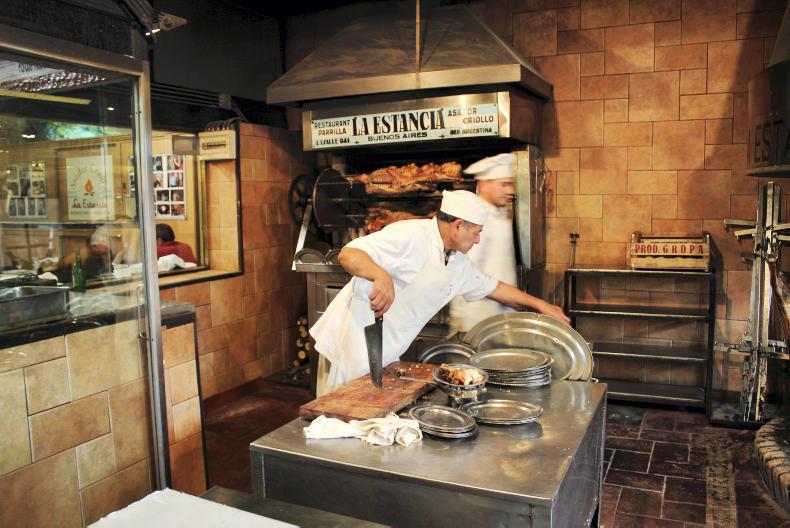

Argentina had been a huge exporter of beef up until 2005 but then government policy imposed huge export tariffs on beef to keep the product affordable for domestic consumers who eat the most beef in the world apart from Uruguay at 57kgs per person, three times as much as Ireland. With the return of the socialist President at the end of 2019, developing international trade is a lower priority and export tariffs, which had been reduced, have been increased to 9%.

Overall the Argentinian economy is in serious trouble with the IMF forecasting a decline in the economy of 5.7% this year and a huge national debt which they are trying to restructure. The currency has collapsed over the past five years from ARS9.68 = €1 to ARS72 = €1 last week.

Aside from Argentina, there is considerable political instability in Brazil where President Bolsonaro has had senior cabinet resignations

Mercosur and EU

While Argentina have said that their new trade policy is only in relation to current future trade negotiations and that the EU deal was accepted, this has to create some doubt on whether it will ever come into effect. Aside from Argentina, there is considerable political instability in Brazil where President Bolsonaro has had senior cabinet resignations because of his controversial policy on COVID-19. Aside from this, with the Paris climate accord being an integral part of the deal with the EU, the ongoing Amazon policy simply wouldn’t be compatible with the EU position on climate change.

Impact of currency

The EU steak meat market has collapsed with the closure of the restaurant and hospitality sector across Europe. However, if there wasn’t the coronavirus problem, the steak market would be under huge pressure from South American imports because of the currency collapse. The fact that Argentina’s peso is now worth eight times less than this time five years ago means that they have a massive price advantage over product produced and sold in the Eurozone. It is similar if not to the same extent with Brazil where the Real is worth 38% less against the euro than it was this time last year.

EU trade policy

The EU, under the leadership of trade commissioner Phil Hogan, are currently the leading global advocates for free trade. Deals have been concluded with Asian countries and more are in the pipeline with Australia and New Zealand and a mini deal with the USA was being discussed before coronavirus. The Mercosur deal would bring huge advantages to EU car and car parts, pharmaceutical and machinery exporters but at a huge cost to farmers particularly beef producers.

EU farmers, particularly beef producers are at their most vulnerable place for a decade. The most immediate problem is not Mercosur but the fact that there is no market for steak meat and EU support mechanisms that work for dairy don’t really assist beef. The impact of a Mercosur trade deal is a future problem and one that gets worse as the currency of South American countries weakens.

Read more

Threat to South American trade deal with EU

The report from Argentina at the weekend that they were pulling out of Mercosur trade negotiations on deals not yet completed reflects the change of political outlook since the election of President Alberto Fernández late last year. He replaced the more free market orientated Mauricio Macri who was elected in 2015 bringing to an end 10 years of socialist government. It was during his term that Argentina re-emerged as a serious exporter of beef, increasing from 209,000t in 2019 to a predicted 840,000t this year (USDA, carcase weight equivalent – CWE).

Argentina had been a huge exporter of beef up until 2005 but then government policy imposed huge export tariffs on beef to keep the product affordable for domestic consumers who eat the most beef in the world apart from Uruguay at 57kgs per person, three times as much as Ireland. With the return of the socialist President at the end of 2019, developing international trade is a lower priority and export tariffs, which had been reduced, have been increased to 9%.

Overall the Argentinian economy is in serious trouble with the IMF forecasting a decline in the economy of 5.7% this year and a huge national debt which they are trying to restructure. The currency has collapsed over the past five years from ARS9.68 = €1 to ARS72 = €1 last week.

Aside from Argentina, there is considerable political instability in Brazil where President Bolsonaro has had senior cabinet resignations

Mercosur and EU

While Argentina have said that their new trade policy is only in relation to current future trade negotiations and that the EU deal was accepted, this has to create some doubt on whether it will ever come into effect. Aside from Argentina, there is considerable political instability in Brazil where President Bolsonaro has had senior cabinet resignations because of his controversial policy on COVID-19. Aside from this, with the Paris climate accord being an integral part of the deal with the EU, the ongoing Amazon policy simply wouldn’t be compatible with the EU position on climate change.

Impact of currency

The EU steak meat market has collapsed with the closure of the restaurant and hospitality sector across Europe. However, if there wasn’t the coronavirus problem, the steak market would be under huge pressure from South American imports because of the currency collapse. The fact that Argentina’s peso is now worth eight times less than this time five years ago means that they have a massive price advantage over product produced and sold in the Eurozone. It is similar if not to the same extent with Brazil where the Real is worth 38% less against the euro than it was this time last year.

EU trade policy

The EU, under the leadership of trade commissioner Phil Hogan, are currently the leading global advocates for free trade. Deals have been concluded with Asian countries and more are in the pipeline with Australia and New Zealand and a mini deal with the USA was being discussed before coronavirus. The Mercosur deal would bring huge advantages to EU car and car parts, pharmaceutical and machinery exporters but at a huge cost to farmers particularly beef producers.

EU farmers, particularly beef producers are at their most vulnerable place for a decade. The most immediate problem is not Mercosur but the fact that there is no market for steak meat and EU support mechanisms that work for dairy don’t really assist beef. The impact of a Mercosur trade deal is a future problem and one that gets worse as the currency of South American countries weakens.

Read more

Threat to South American trade deal with EU

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: