The past 10 months could be described as lively or exciting but always unpredictable in global grain markets.

We benefited from some of this for harvest prices in 2020 and the trend has been largely upwards since them.

In the knowledge that grain prices very seldom remain ‘high’ for a full 12 months, there must still be a lot of uncertainty for harvest 2021 given that the upward price trend began in August 2020.

The only price that is certain beyond today is the one that has already been taken.

A maize-driven market

Most growers will know that it was tightness in global maize markets that drove grain prices over the past 10 months. Up to then, low-priced maize imports set the tone for native grains but this product has seen dramatic price increases for the nearby and new-crop markets.

Imported maize that cost buyers less than €170/t ex-port in recent years is currently floating either side of €280/t and around €240/t for new crop.

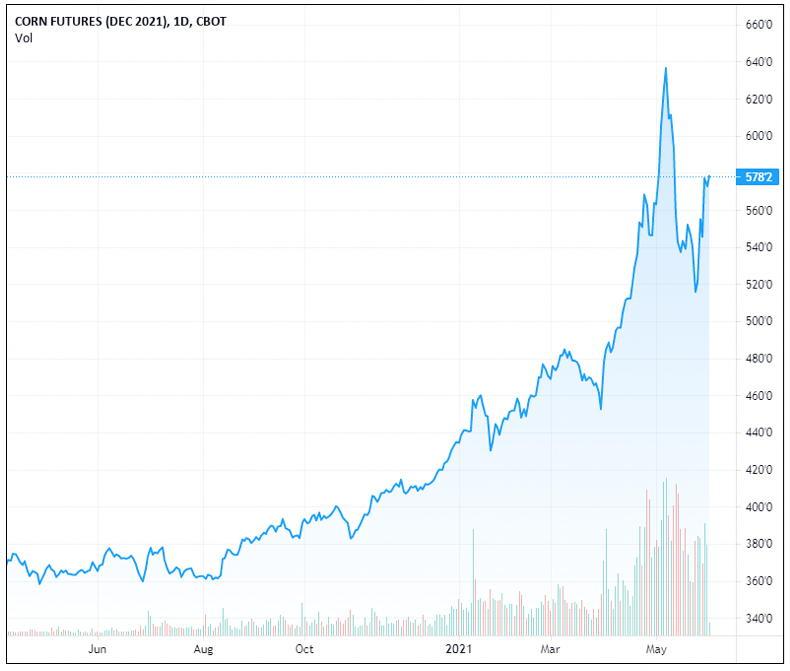

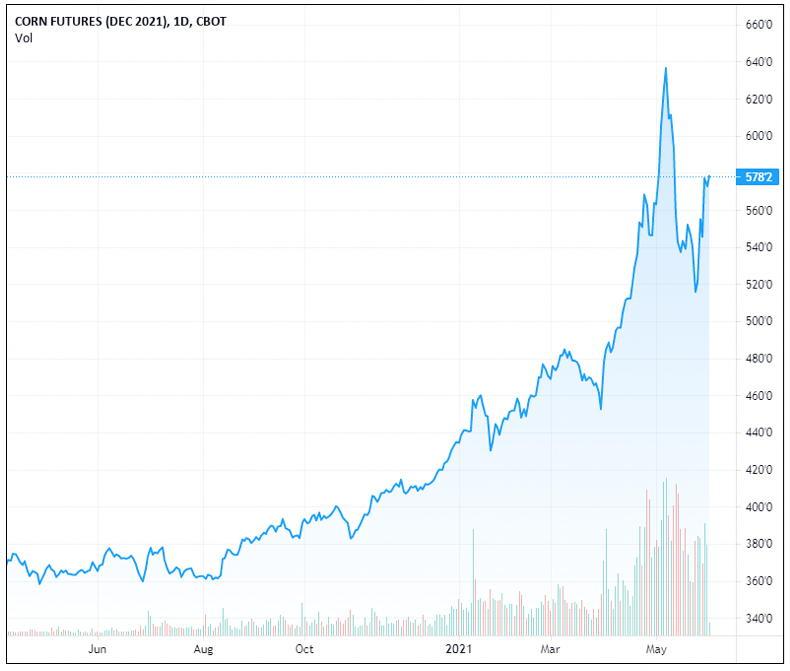

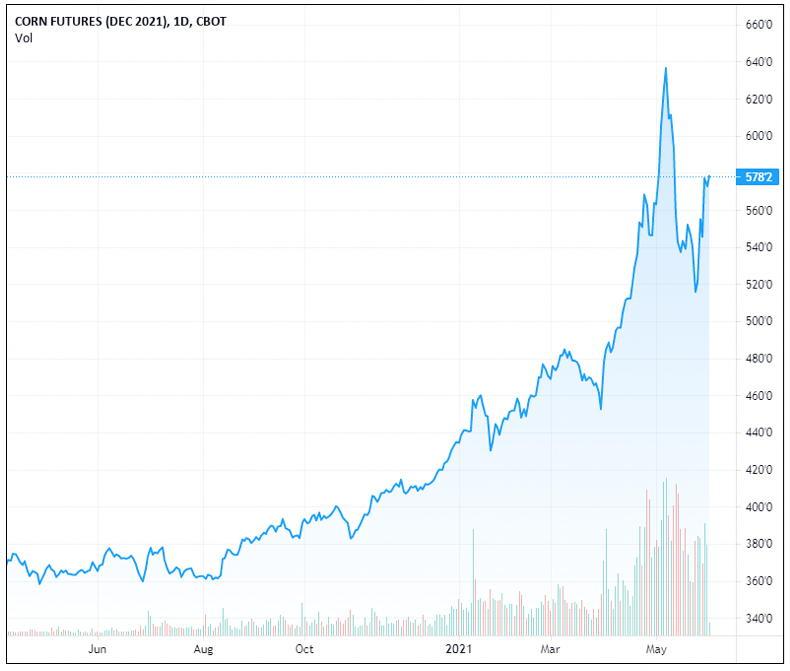

The reason this can be seen in Figure 1.

Figure 1. Chicago December maize futures prices since June 2020 as captured on 3 June 2021.

This shows the December 21 daily price for corn (maize) on the Chicago futures market in cents per bushel. This shows that maize was trading at just over 360c/bu ($3.60/bu or $141.72/t or €116.72/t) for much of last summer but prices picked up in August. Lower than anticipated production and high demand from China triggered the change in sentiment.

Using the same currency conversion rates, maize last week traded at $223.22/bu or €183.84/t – up 57% even with the recent falls. The scale of the price movement is clearly visible in Figure 1, along with a few bumps here and there.

It is worth noting that the small green and red bars at the bottom of Figure 1 indicate the scale of fund activity in the market. One can see higher fund activity (purchases) at higher price levels and the red bars, associated with selling activity, where the prices dipped. These are particularly noticeable for the price dips in late April and mid-May.

Closer to home

While these are US prices, they are reflected in global markets. Figure 2 shows the price of nearby dry wheat and barley relative to imported maize ex-port on any given week.

The extent of the price movement can be seen in Figure 2, with things generally changing from August. At that time imported maize had been down at €175/t and a huge amount of import business had been done around these price levels. Back then maize was trading below wheat and very close to barley.

Even with the maize price increases in 2020 it was still cheaper than native wheat in January. However, maize prices continued upwards and fluctuated around wheat in the early months of 2021 before really taking off in early April. This was in response to decreasing global stocks combined with production fears for 2021.

Another point worth noting from Figure 2 is the relative price gap between native wheat and barley. Barley had been trading at either side of €170/t for much of 2020, which was +/– €25/t lower than wheat. This heavy discount was a consequence of higher global barley production following the difficulties in planting winter wheat in the autumn of 2019.

During this timespan there were many different influences in the market. Most related to the tightness of maize supply and the high demand from China

This heavy discount continued up to recently as barley was competing, not with the price of nearby imported maize but at the price levels that pertained during active maize buying in the previous year. It was only when the low-priced maize was used and replacement imports became expensive that a strong demand for barley returned. In time, this pulled the price differential back to the more traditional €10/t difference between wheat and barley.

During this timespan there were many different influences in the market. Most related to the tightness of maize supply and the high demand from China. There were also dryness concerns in many regions and in particular in Russia, parts of the US and South America. Investment funds were also a factor in both the up and down movement.

Looking forward

For many growers, the 2020/21 market is history and issues relating to new-crop prices are far more relevant. While price levels are currently higher than last harvest, they provide no guarantee of where prices will be come harvest. And if we move into a period of declining prices come harvest, our prices will not be agreed until we are nearly at the bottom of that trough.

Two weeks ago, the MATIF December wheat futures dropped to €204.50/t. If it had dropped below that level there was a feeling in the market that it could drop back to €190/t. That’s the risk of not taking some forward cover when price levels were good (see Figure 3).

Whether or not prices return to the levels seen in late April/early May remains to be seen.

There are still big uncertainties as we look towards harvest. Current production forecasts hinge heavily on the area planted to maize in the US and the size of the maize harvest in Brazil.

Many believe the planted area in the US will be higher than is predicted and that would increase supply. And if the Brazil crop happens to be higher than forecast, we could see a complete change in price sentiment.

Dryness is a concern for this harvest

Russian wheat production brings additional uncertainty. Dryness is a concern for this harvest, as is its policy on export taxes and the potential for its increasing stock levels to be pushed back into the market come harvest, or before.

Current forecasts suggest 2021 global grain production will set a record of 2,292Mt, up 72Mt on this year and 60Mt of which is additional maize.

Malting barley is a very important crop for many Irish growers

But carryover stocks of maize are decreasing while those of wheat are rising. This gives rise to different market sentiment for these crops but they remain linked in the international grains market.

Malting barley is a very important crop for many Irish growers. While overall demand for malt was hit by the constraints of the pandemic, malting barley prices moved with overall grain market sentiment.

Creil futures prices have been relatively strong and past prices are used to formulate harvest price, which is set at €222.57/t for in-spec barley this harvest. How this fares in relation to feeding barley remains to be seen but it seems more likely than not to represent a good premium.

Grain prices have been on the rise since last August but forward prices remain very uncertain following recent price drops.Demand for and supply of maize have been the major drivers of global grain prices over the past 10 months. Tight market supply makes weather a very important factor in market sentiment for the coming harvest, as seen again this week.

The past 10 months could be described as lively or exciting but always unpredictable in global grain markets.

We benefited from some of this for harvest prices in 2020 and the trend has been largely upwards since them.

In the knowledge that grain prices very seldom remain ‘high’ for a full 12 months, there must still be a lot of uncertainty for harvest 2021 given that the upward price trend began in August 2020.

The only price that is certain beyond today is the one that has already been taken.

A maize-driven market

Most growers will know that it was tightness in global maize markets that drove grain prices over the past 10 months. Up to then, low-priced maize imports set the tone for native grains but this product has seen dramatic price increases for the nearby and new-crop markets.

Imported maize that cost buyers less than €170/t ex-port in recent years is currently floating either side of €280/t and around €240/t for new crop.

The reason this can be seen in Figure 1.

Figure 1. Chicago December maize futures prices since June 2020 as captured on 3 June 2021.

This shows the December 21 daily price for corn (maize) on the Chicago futures market in cents per bushel. This shows that maize was trading at just over 360c/bu ($3.60/bu or $141.72/t or €116.72/t) for much of last summer but prices picked up in August. Lower than anticipated production and high demand from China triggered the change in sentiment.

Using the same currency conversion rates, maize last week traded at $223.22/bu or €183.84/t – up 57% even with the recent falls. The scale of the price movement is clearly visible in Figure 1, along with a few bumps here and there.

It is worth noting that the small green and red bars at the bottom of Figure 1 indicate the scale of fund activity in the market. One can see higher fund activity (purchases) at higher price levels and the red bars, associated with selling activity, where the prices dipped. These are particularly noticeable for the price dips in late April and mid-May.

Closer to home

While these are US prices, they are reflected in global markets. Figure 2 shows the price of nearby dry wheat and barley relative to imported maize ex-port on any given week.

The extent of the price movement can be seen in Figure 2, with things generally changing from August. At that time imported maize had been down at €175/t and a huge amount of import business had been done around these price levels. Back then maize was trading below wheat and very close to barley.

Even with the maize price increases in 2020 it was still cheaper than native wheat in January. However, maize prices continued upwards and fluctuated around wheat in the early months of 2021 before really taking off in early April. This was in response to decreasing global stocks combined with production fears for 2021.

Another point worth noting from Figure 2 is the relative price gap between native wheat and barley. Barley had been trading at either side of €170/t for much of 2020, which was +/– €25/t lower than wheat. This heavy discount was a consequence of higher global barley production following the difficulties in planting winter wheat in the autumn of 2019.

During this timespan there were many different influences in the market. Most related to the tightness of maize supply and the high demand from China

This heavy discount continued up to recently as barley was competing, not with the price of nearby imported maize but at the price levels that pertained during active maize buying in the previous year. It was only when the low-priced maize was used and replacement imports became expensive that a strong demand for barley returned. In time, this pulled the price differential back to the more traditional €10/t difference between wheat and barley.

During this timespan there were many different influences in the market. Most related to the tightness of maize supply and the high demand from China. There were also dryness concerns in many regions and in particular in Russia, parts of the US and South America. Investment funds were also a factor in both the up and down movement.

Looking forward

For many growers, the 2020/21 market is history and issues relating to new-crop prices are far more relevant. While price levels are currently higher than last harvest, they provide no guarantee of where prices will be come harvest. And if we move into a period of declining prices come harvest, our prices will not be agreed until we are nearly at the bottom of that trough.

Two weeks ago, the MATIF December wheat futures dropped to €204.50/t. If it had dropped below that level there was a feeling in the market that it could drop back to €190/t. That’s the risk of not taking some forward cover when price levels were good (see Figure 3).

Whether or not prices return to the levels seen in late April/early May remains to be seen.

There are still big uncertainties as we look towards harvest. Current production forecasts hinge heavily on the area planted to maize in the US and the size of the maize harvest in Brazil.

Many believe the planted area in the US will be higher than is predicted and that would increase supply. And if the Brazil crop happens to be higher than forecast, we could see a complete change in price sentiment.

Dryness is a concern for this harvest

Russian wheat production brings additional uncertainty. Dryness is a concern for this harvest, as is its policy on export taxes and the potential for its increasing stock levels to be pushed back into the market come harvest, or before.

Current forecasts suggest 2021 global grain production will set a record of 2,292Mt, up 72Mt on this year and 60Mt of which is additional maize.

Malting barley is a very important crop for many Irish growers

But carryover stocks of maize are decreasing while those of wheat are rising. This gives rise to different market sentiment for these crops but they remain linked in the international grains market.

Malting barley is a very important crop for many Irish growers. While overall demand for malt was hit by the constraints of the pandemic, malting barley prices moved with overall grain market sentiment.

Creil futures prices have been relatively strong and past prices are used to formulate harvest price, which is set at €222.57/t for in-spec barley this harvest. How this fares in relation to feeding barley remains to be seen but it seems more likely than not to represent a good premium.

Grain prices have been on the rise since last August but forward prices remain very uncertain following recent price drops.Demand for and supply of maize have been the major drivers of global grain prices over the past 10 months. Tight market supply makes weather a very important factor in market sentiment for the coming harvest, as seen again this week.

SHARING OPTIONS