The best that can be said about Irish factory prices is that they have stabilised, though it is at the lower end of the range that might be expected, especially for young bulls where the R3 grade is worth 12c/kg less in Irish factories than an O3 cow in Sweden (excluding VAT).

We are now in peak slaughter season for factories building stocks of beef for Christmas markets, particularly for the UK retail sector.

This has given the trade in the North and Britain a push and with sterling hovering at a rate of just over 86p to €1, farmers will be hoping that some of this demand will give Irish prices a nudge upwards.

China

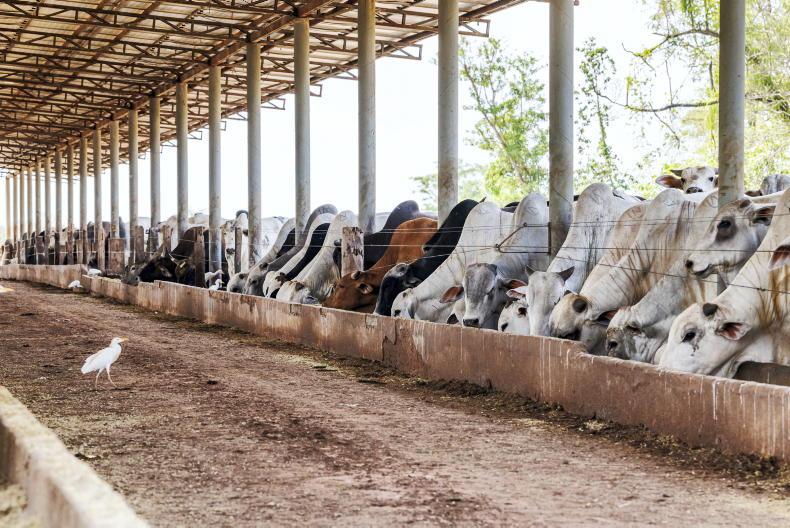

China has been the one positive story of the Irish beef industry this year, even though it too brings its own problems. The demand for all types of meat from China has triggered a surge in exports from the Mercosur countries.

As the Chinese demand is for slower-cooked forequarter cuts of beef that include a sauce, it means that the surplus steak meat is finding its way to the EU at particularly low price points and it is expected that up to 60,000t of imports from South America this year will enter the EU with full WTO tariff paid.

The problems farmers have had recently in getting over-30-month cattle away are likely to continue

The other big issue with the Chinese market is that it has a strict 30-month age specification and no matter how little of the carcase is going to China, the entire animal must be under 30 months on the day of slaughter.

With so many Irish factories now approved and good to go with building their first load, we can expect that all will be wanting cattle under 30 months.

This means that the problems farmers have had recently in getting over-30-month cattle away are likely to continue. If the Chinese market develops as expected over the next year, then the 30-month limit will be an even bigger issue.

Irish beef exports increase again

China’s beef imports for this year reached 1.1m tonnes by the end of September, meaning that 2018’s total import figure of 1.039m tonnes has been passed.

The Irish share of this market increased again to 931t in September, up from 907t the previous month from the seven factories that were approved at that point to supply China.

This Irish share is small, but will grow as supplies from the further 14 Irish premises, approved last month, come on stream over the coming weeks and months.

Currently, most of the 1.1m tonnes of beef imported by China is supplied by five countries. Argentina is the biggest supplier with 22.8% of this, Brazil 21.4%, Uruguay 19.6%, Australia 17.8% and New Zealand has a 14.4% share of China’s beef imports, according to information supplied by Bord Bia’s China office.

Carcase balance

With China - and to a slightly lesser extent the USA - driving the global demand for manufacturing beef from the forequarter, there is a problem with oversupply of the roasting and steak meat cuts.

Traditionally, the UK and wider EU was a good market for these, especially roasting cuts, but they are out of favour with consumers in the UK.

Additionally, there is the question of steak meat coming into the EU from outside, devaluing further an already weak market.

All of this means that the most valuable cuts of meat from the carcase are in reducing demand and value, which in turn will put further medium-term pressure on specialised suckler beef.

Ultimately, the Chinese market could give with one hand, in taking a big volume of Irish exports, but take with the other, in leaving an EU market oversupplied with steak meat. It is doubtful if the market alone can restore prices and farmer confidence in beef production.

Read more

Creed announces visit to China

The best that can be said about Irish factory prices is that they have stabilised, though it is at the lower end of the range that might be expected, especially for young bulls where the R3 grade is worth 12c/kg less in Irish factories than an O3 cow in Sweden (excluding VAT).

We are now in peak slaughter season for factories building stocks of beef for Christmas markets, particularly for the UK retail sector.

This has given the trade in the North and Britain a push and with sterling hovering at a rate of just over 86p to €1, farmers will be hoping that some of this demand will give Irish prices a nudge upwards.

China

China has been the one positive story of the Irish beef industry this year, even though it too brings its own problems. The demand for all types of meat from China has triggered a surge in exports from the Mercosur countries.

As the Chinese demand is for slower-cooked forequarter cuts of beef that include a sauce, it means that the surplus steak meat is finding its way to the EU at particularly low price points and it is expected that up to 60,000t of imports from South America this year will enter the EU with full WTO tariff paid.

The problems farmers have had recently in getting over-30-month cattle away are likely to continue

The other big issue with the Chinese market is that it has a strict 30-month age specification and no matter how little of the carcase is going to China, the entire animal must be under 30 months on the day of slaughter.

With so many Irish factories now approved and good to go with building their first load, we can expect that all will be wanting cattle under 30 months.

This means that the problems farmers have had recently in getting over-30-month cattle away are likely to continue. If the Chinese market develops as expected over the next year, then the 30-month limit will be an even bigger issue.

Irish beef exports increase again

China’s beef imports for this year reached 1.1m tonnes by the end of September, meaning that 2018’s total import figure of 1.039m tonnes has been passed.

The Irish share of this market increased again to 931t in September, up from 907t the previous month from the seven factories that were approved at that point to supply China.

This Irish share is small, but will grow as supplies from the further 14 Irish premises, approved last month, come on stream over the coming weeks and months.

Currently, most of the 1.1m tonnes of beef imported by China is supplied by five countries. Argentina is the biggest supplier with 22.8% of this, Brazil 21.4%, Uruguay 19.6%, Australia 17.8% and New Zealand has a 14.4% share of China’s beef imports, according to information supplied by Bord Bia’s China office.

Carcase balance

With China - and to a slightly lesser extent the USA - driving the global demand for manufacturing beef from the forequarter, there is a problem with oversupply of the roasting and steak meat cuts.

Traditionally, the UK and wider EU was a good market for these, especially roasting cuts, but they are out of favour with consumers in the UK.

Additionally, there is the question of steak meat coming into the EU from outside, devaluing further an already weak market.

All of this means that the most valuable cuts of meat from the carcase are in reducing demand and value, which in turn will put further medium-term pressure on specialised suckler beef.

Ultimately, the Chinese market could give with one hand, in taking a big volume of Irish exports, but take with the other, in leaving an EU market oversupplied with steak meat. It is doubtful if the market alone can restore prices and farmer confidence in beef production.

Read more

Creed announces visit to China

SHARING OPTIONS