Drought in New Zealand is stirring some positive signals on 2018 milk price for Europe and Ireland.

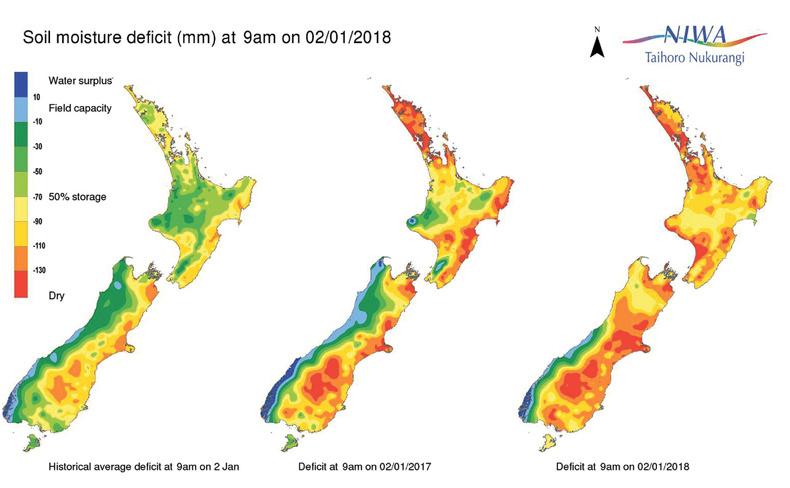

New Zealand, as a large exporter of dairy product, is in full milk production at the moment and a serious drought is affecting many dairy farms.

While rain in the last day or two has helped changed the colour of farms in parts of the country, there will be consequences on milk supply irrespective of what happened or what will happen over the next few days and weeks.

Already, some farms have dried off herds in the North Island. More have started grazing fodder crops as the all grass is gone.

Others are feeding over half the diet as supplement, driving up the cost of production.

31mm since 9am yesterday has turned brown to green. Have to admit was very down and staring at a febmar dry off was getting to me. Hope this weather gives everyone a second half of a season and helps lift spirits in 2018. #allinthistogether pic.twitter.com/2KBooNY0NP

— Sam Owen (@samueltowen) January 2, 2018

There are herds in coastal Taranaki drying off. They have nothing. Even the little bit of standing straw they had is now gone. Crops completely failed. As in entire hectares with just a few weeds germinated. Can’t get PKE, can’t get silage... there’s no alternative.

— Matthew Herbert (@m_herbert) December 31, 2017

At the end of December, Fonterra released a statement suggesting its milk collections will be down between 3% and 4% on what it had forecast earlier in season due to the dry weather.

Despite anticipating rain for early January, it expected longer-lasting effects. It revised down annual volumes by 45m kg of milk solids.

That’s the equivalent of the entire lactation performance of over 100,000 cows at 400kg of milk solids per cow. It’s a lot of milk by any calculation.

In Europe, milk supply has increased from some of the big dairy regions in Europe in the last two months as higher prices drive higher volumes.

However, the EU delivery figures for the period from January to October 2016 compared with January to October 2017 show the French supply down 1.2%, and the Germans down 1.2%.

The UK is only up 0.7%, yet it is still well behind what it produced in 2014 and 2015.

Some milk buyers over there have already made decisions for February, March and April supply.

Müller is to hold its milk price for February. Following Müller’s previously announced 1.5p/l January price cut, it has followed up with an announcement that farmgate milk prices will be held until 1 March with no change for February.

Lactalis also announced last week they that it has also told suppliers it will hold milk price until 1 April.

Market sentiment

Sentiment drives dairy markets and global product buyers are at best reluctant to make long-term decisions when there is a lot of issues at play, such as big weather events in certain parts of the world.

The New Zealand milk supply restriction or at least ‘‘buyer indecision’’ will undoubtedly impact positively on European milk price as lower New Zealand supply means less product for a growing export market.

SHARING OPTIONS