With just fifty three weeks until Scotland leaves the EU there was a sense of progress in Brussels this week when Department for Exiting the EU (DExEU) Minister David Davis and his counterpart from the EU Commission announced a transition or implementation period once the UK leaves the EU in March 2019. This will run until 30 December 2020 and means that in the area of commerce or trade there will be no significant operational change before then.

This is good news for Scottish farmers, even if fishermen were disappointed. It means that the support mechanism that has been in place for farmers through the Common Agriculture Policy will continue and access to export markets which are particularly important for Scottish sheep producers will remain. Even for beef, while the vast majority of sales outside Scotland are to the rest of the UK, the small percentage that is sold in the rest of the EU adds considerable value to the carcase.

Beef processing is a reversal of the normal production line principle. When making cars, a factory assembles hundreds of component parts into a finished car. With beef it is the other way round – they start off with a complete animal and proceed to break it down into its component parts. It is the ability to sell each component in its highest value market that maximises the return of the overall animal.

What next?

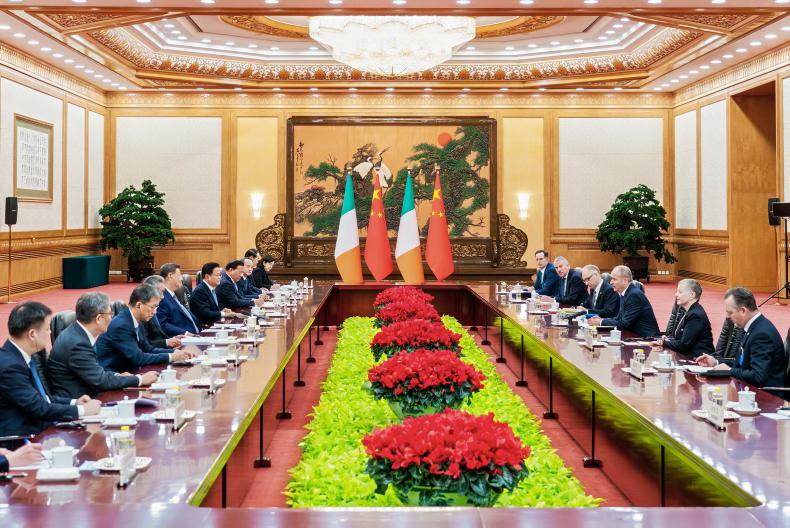

Now that the negotiators have agreed a transition period, it is over to the 27 EU heads of state to agree a negotiating mandate for Michel Barnier to proceed with discussions on a future trade agreement with the UK. However, not all elements of the exit deal are concluded. The negotiators decided to display on a large screen the areas of text shaded in green that had been signed off and while they are in the majority, there are still gaps. The most significant of these is the Irish border where the back-stop option as it is referred to isn’t the preferred option of either the UK government nor much of Northern Ireland opinion.

It is the ambition of UK negotiators that this won’t be an issue in the final shake out with either an overall trade deal or a technological solution removing the need for the back-stop of Northern Ireland remaining aligned to the EU to prevent the need for a hard border on the island of Ireland. That scenario of course leaves the question about Northern Ireland and its position politically and from a trade perspective with the rest of the UK. Indeed for exports from the Republic of Ireland, it isn’t the border with Northern Ireland that is the problem but access to the British market.

Free to negotiate trade deals

The big win for the UK in the agreement announced in Brussels this week is the freedom to begin trade negotiations with other countries immediately on departing the EU in March 2019. Previously the EU position had been that the UK couldn’t start any negotiation during a transition period but have now moved to accommodate negotiations, even agreement, but no implementation can occur until the transition period has ended.

This window will give some indication of the direction of travel by the UK whenever it has full autonomy to enter into global trade deals. For Scottish and indeed wider UK farmers, especially those involved in beef production, the concern will be that generous access to the UK market could be granted in a trade negotiation.

The one that springs immediately to mind is with the Mercosur group of South American countries. They have been involved in prolonged negotiations with the EU but no deal has been forthcoming because the EU have been unable to grant them sufficient access for beef. So far they have offered 70,000t with an indication that this could move close to 100,000t if the EU gets the access it wants on cars and industrial goods. Any beef offer has met with huge resistance, led by France and strongly supported by Ireland.

Possible UK trade negotiations

Of course the UK would approach a negotiation with Mercosur with different priorities. The big UK offensive interests, ie what the UK wants to sell, are financial services including banking and insurance. While access for beef is a defensive issue for the EU ie it wants to keep access to a minimum, the UK have more flexibility being a net importer of beef, three quarters of which comes from Ireland. If the UK were to grant a generous level of access for Mercosur beef, it would displace Irish as the import of choice and likely weaken the overall Scottish and UK market as well given that it is so much cheaper at present with good quality steer beef in Brazil making the equivalent of €2/kg.

Other countries that could be a target for trade deals have equally strong agri-food interests. Australia and New Zealand are huge exporters of beef and sheepmeat while the USA is one of the largest exporters of beef in the world even though it is also one of the largest importers.

Any discussions with the USA are likely to bring the issue of standards to the fore. The USA use growth promoting hormones which are banned in the EU as well as a lactic acid to wash carcases and cuts of beef. The USA have made clear that any trade discussions with the UK would mean accepting US standards, while DEFRA Secretary Michael Gove is on record as saying there will be no compromise of UK standards post-Brexit.

The transition period post-Brexit will give an indication to farmers the direction of travel on trade that the Government are likely to follow. Most trade deals means giving access on agriculture and this has the potential to depress the market for farmers.

It is also likely to have an influence on parallel discussions with the EU on a future trading relationship as enhanced access to the UK beef from outside the EU would create a knock on problem with Irish beef looking for a market in mainland Europe.

SHARING OPTIONS