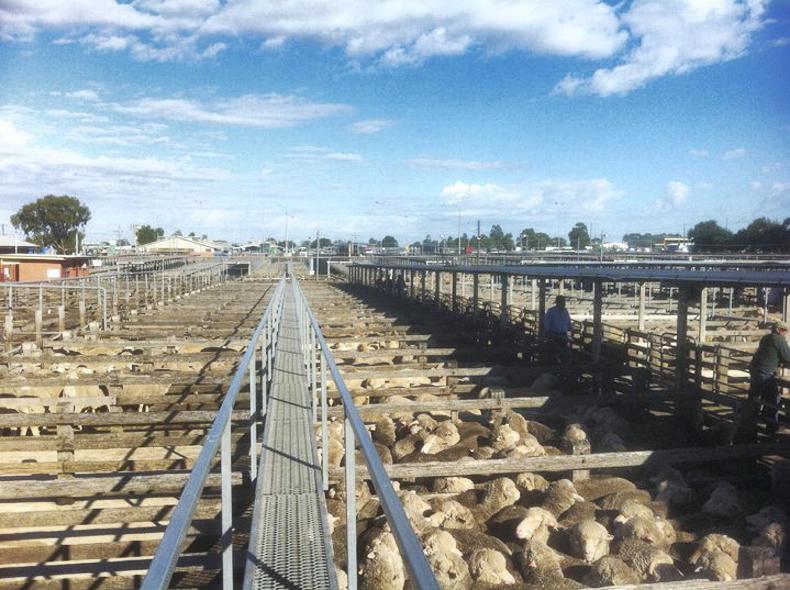

Record sheep prices and throughput in Australia

The Australian agricultural sector has been grappling on and off with drought in recent years, with many parts of the country once again having to come to terms with drought conditions since late last year. It is a significant blow for regions which had been rebuilding sheep flocks and beef or dairy herds after heavy drought-related culling.

The latest Meat and Livestock Australia (MLA) slaughter report states: “Despite the intention of many producers to expand the flock in 2018, poor seasonal conditions have seen monthly sheep slaughter at raised levels, particularly since April. Mutton slaughter, which typically reaches an annual low point in June (lambing commencing), totalled 563,000 head, up 35% on 2017 and up 19% on the five-year average.”

This confirms that, once again, the sector is experiencing heavy culling in its national ewe flock. For the year to June, sheep slaughter throughput reached 4.15m head, an increase of 26% on 2017 levels.

The MLA report states that this may have negative consequences on lamb supply later in the year. “The combined factors of high slaughter and extended drought in major supply regions across NSW, Victoria and SA have once again brought into question the supply of finished lambs later in the year.”

The number of lambs/hoggets slaughtered in the year to date has also reached record levels, with drought and record prices encouraging finishers to continue to supplement lambs despite high feed costs and low pasture availability.

Sheep prices have reached record levels in recent weeks, as detailed in Figure 1, with the latest Bord Bia price report for 11 August listing the Australian lamb price at the equivalent of €4.87/kg.

This is a lift of over 80c/kg since the start of June and brings Australian sheep prices into previously unknown territory.

The level of feeding is reflected in the average lamb carcase weight in June remaining stable at just over 23kg.

Spike in throughput

This follows a sharp decline in the average carcase weight delivered in May, with finishers moving to reduce feed costs and marketing lambs at lighter weight. This led to lamb throughput spiking in May at over 2.4m head.

The number of sheep slaughtered in June is also running ahead of the five-year average at 1.88m head.

This continued high level of throughput has also underpinned record throughput for the year to June at 12 million head, higher than any other yearly figures since Australian Bureau of Statistics records commenced in January 1970.

In another report, MLA highlights that there is concern about the level of exposure the processing sector is experiencing. It states that processors are caught in a situation of having to service export markets in emerging markets for fear of losing out to competitors.

Sharp jump in Chinese exports

Like New Zealand, Australia has witnessed a sharp jump in sheepmeat exports to China. MLA reports the market has developed into Australia’s single-largest export destination by volume for the last two years, with 2018 experiencing a surge in export volumes to reach an all-time record of 55,000t carcase weight equivalent, an increase of 43% for the January to July period year on year.

However, the report on the Chinese sheep sector points to volatility as being a concern. It says that China is forecasting growth in the sheep flock over the next 10 years in both the number of sheep farmed and productivity.

This could be limited by continued drought in key sheep-producing areas and foot and mouth disease.

North Asia main market for New Zealand lamb exports

The latest New Zealand lamb export figures for the 2017/2018 season from October to the end of July underlines the rising importance of the Asian market for sheepmeat exports.

Figure 2 details figures published by Beef and Lamb New Zealand, which shows North Asia overtaking the EU for lamb exports.

It shows a clear trend of a rising demand and a higher proportion of exports heading to Asia over the EU, with China and Hong Kong the main markets underpinning the higher volumes.

This has occurred at a time when New Zealand prices are running at a five-year high and close to record levels. Exports to the EU recorded an increase on the back of a lift in total export volumes, but it is certain that volumes exported to the EU will continue to run well below New Zealand’s tariff-free quota of 227,000t with less than 70% of the quota utilised in recent years.

Meanwhile, the results of the latest stock number survey on 30 June 2018 have recorded a further decline in the New Zealand national ewe flock. The number of ewes fell 2.1% or from 17.76m head to 17.37m head, with the report pointing to record cull ewe prices as an underlying factor, while there is also an ongoing switch in some regions to less labour-intensive cattle and deer enterprises.

The number of hoggets retained increased from 8.88m head to 9.11m head and while this is seen as a positive factor, it is not comparable to the extent of the reduction in ewe numbers. The knock-on effect of a reduced ewe flock and scanning results falling below expectations is a smaller lamb crop, with estimates pointing to the lamb crop reducing by a massive 900,000 head to 22.78m head.

Heatwave dents UK lamb sales

The AHDB reports lamb sales suffering during the higher than normal temperatures. The report says: “Primary lamb cuts (including chops, mince and roasting joints) suffered badly in the hot weather, with the volume of fresh and frozen lamb cuts declining by 9% year on year in the 12 weeks ending 12 July.”

It also highlights that an increase in the average retail price may also have contributed to the drop in sales. There were significant reductions in nearly all category cuts, with the total spend on fresh and frozen lamb declining 6% compared with earlier levels.

This is in contrast with a significant upturn in fortunes for all competing proteins. Beef burger and grill sales are reported as increasing 19% compared with 2017 levels, with fresh product sales increasing by almost 30%. This was despite a 3% increase in prices. However, primary beef cuts suffered the same fate as lamb cuts, with sales declining 3% despite retail prices falling 0.5%. Pork sales recorded a 1% increase driven by sausages (+4%) and pork pies (+5%) while poultry sales increased 8%, helped by a 3% reduction in average sale prices.

Japan approves US sheep and goat export resumption

US Secretary of Agriculture Sonny Perdue announced on 12 July that the Japanese government had finalised technical requirements that will allow US sheep and goat exports to resume after a 14-year break. Exports halted in 2003 after an outbreak of BSE in the cattle herd. Japan is the leading value market for US beef and pork, with high hopes that lamb will now follow. The USDA reports Japanese sheep and goat meat imports reaching $169m (€146.6m) in 2017 with imports coming primarily from Australia and New Zealand. Japan is another country where pressure has been growing to develop trade links for Irish and EU sheepmeat following last year’s trade announcement for beef.

US 2018 sheepmeat imports increase

Higher processing activity as a result of drought and record prices in Australia has contributed to an increase in US sheep meat imports. USDA market analysis to 11 August shows imports from Australia totalling 36,655t for lamb and 10,580t for mutton, an increase of approximately 9% on 2017 levels.

Imports from New Zealand are also steady, with 17,657t of lamb and 2,753t of mutton imported. The two countries dominate US imports, with just 296t imported from Chile, 70t from Canada, 62t from Uruguay and 34t from Mexico.

Previous reports point to a spike in imports in April and May as inserting pressure on to the US lamb trade and contributing to an increase in the volume of sheepmeat entering into cold stocks before being released for holiday periods. The pressure on the trade has abated, with the latest price report reporting a strengthening in the trade ahead of the Eid al-Adha festival.

The American sheep industry is relatively small, with output on a similar level to Ireland, despite the massive gulf in size between the two countries.

The US ewe flock has been on a declining trend in recent years and recorded a further decrease of 40,000 head to 3,005,000 from January 2017 to 2018. The number of flock replacements recorded stood at 655,000 head, a reduction of 5,000 head on the previous year. Flock productivity is at a lower level, with output estimated at 1.05 lambs per ewe.

However, this is compensated for by sheep being brought to heavier weights. The average liveweight for sheep slaughtered in the week ending 4 August 2018 was recorded at 63kg liveweight and a carcase weight just shy of 32kg.

Weekly throughput is currently averaging around 37,000 head with annual throughput up 2.9% at 1.245m head.

Mayo Mule sale clarification

Last week’s report on the Mayo Mule and Greyface Group introducing a new two-day sales format for the 2018 premier sale incorrectly listed the sale dates for hoggets and ewe lambs.

It should have stated that the premier sale of hoggets takes place on Friday 24 August, with ewe lambs on Saturday 25 August.

EID Sheepnet survey

The Sheepnet project, involving the six main sheep-producing countries in the EU (Ireland, France, Italy, Spain, Romania and the UK) along with Turkey, is seeking sheep producers to complete a survey developed to assess the level of EID technology use among sheep producers. The survey contains simple background questions and aims to gauge farmers’ views on the benefits and/or limitations of EID and reasons for implementing or not implementing EID technology at farm level. It can be accessed at http://limesurvey.idele.fr/index.php/677643/lang-en.

Sheep Ireland ram catalogue

The final catalogue for the Sheep Ireland elite €uro-Star multi-breed ram sale, which takes place this Saturday 25 August in Tullamore Mart, Co Offaly, is available on www.sheep.ie.

The sale of 326 rams from nine breeds – Belclare (42), Beltex (2), Charollais (106), Hampshire Down (4), Lleyn (2), Rouge de l’Ouest (6), Suffolk (58), Texel (93) and Vendéen (13) – commences at 12pm, with sheep sold in two rings. All lambs are five stars on the terminal OR replacement index.

Record sheep prices and throughput in Australia

The Australian agricultural sector has been grappling on and off with drought in recent years, with many parts of the country once again having to come to terms with drought conditions since late last year. It is a significant blow for regions which had been rebuilding sheep flocks and beef or dairy herds after heavy drought-related culling.

The latest Meat and Livestock Australia (MLA) slaughter report states: “Despite the intention of many producers to expand the flock in 2018, poor seasonal conditions have seen monthly sheep slaughter at raised levels, particularly since April. Mutton slaughter, which typically reaches an annual low point in June (lambing commencing), totalled 563,000 head, up 35% on 2017 and up 19% on the five-year average.”

This confirms that, once again, the sector is experiencing heavy culling in its national ewe flock. For the year to June, sheep slaughter throughput reached 4.15m head, an increase of 26% on 2017 levels.

The MLA report states that this may have negative consequences on lamb supply later in the year. “The combined factors of high slaughter and extended drought in major supply regions across NSW, Victoria and SA have once again brought into question the supply of finished lambs later in the year.”

The number of lambs/hoggets slaughtered in the year to date has also reached record levels, with drought and record prices encouraging finishers to continue to supplement lambs despite high feed costs and low pasture availability.

Sheep prices have reached record levels in recent weeks, as detailed in Figure 1, with the latest Bord Bia price report for 11 August listing the Australian lamb price at the equivalent of €4.87/kg.

This is a lift of over 80c/kg since the start of June and brings Australian sheep prices into previously unknown territory.

The level of feeding is reflected in the average lamb carcase weight in June remaining stable at just over 23kg.

Spike in throughput

This follows a sharp decline in the average carcase weight delivered in May, with finishers moving to reduce feed costs and marketing lambs at lighter weight. This led to lamb throughput spiking in May at over 2.4m head.

The number of sheep slaughtered in June is also running ahead of the five-year average at 1.88m head.

This continued high level of throughput has also underpinned record throughput for the year to June at 12 million head, higher than any other yearly figures since Australian Bureau of Statistics records commenced in January 1970.

In another report, MLA highlights that there is concern about the level of exposure the processing sector is experiencing. It states that processors are caught in a situation of having to service export markets in emerging markets for fear of losing out to competitors.

Sharp jump in Chinese exports

Like New Zealand, Australia has witnessed a sharp jump in sheepmeat exports to China. MLA reports the market has developed into Australia’s single-largest export destination by volume for the last two years, with 2018 experiencing a surge in export volumes to reach an all-time record of 55,000t carcase weight equivalent, an increase of 43% for the January to July period year on year.

However, the report on the Chinese sheep sector points to volatility as being a concern. It says that China is forecasting growth in the sheep flock over the next 10 years in both the number of sheep farmed and productivity.

This could be limited by continued drought in key sheep-producing areas and foot and mouth disease.

North Asia main market for New Zealand lamb exports

The latest New Zealand lamb export figures for the 2017/2018 season from October to the end of July underlines the rising importance of the Asian market for sheepmeat exports.

Figure 2 details figures published by Beef and Lamb New Zealand, which shows North Asia overtaking the EU for lamb exports.

It shows a clear trend of a rising demand and a higher proportion of exports heading to Asia over the EU, with China and Hong Kong the main markets underpinning the higher volumes.

This has occurred at a time when New Zealand prices are running at a five-year high and close to record levels. Exports to the EU recorded an increase on the back of a lift in total export volumes, but it is certain that volumes exported to the EU will continue to run well below New Zealand’s tariff-free quota of 227,000t with less than 70% of the quota utilised in recent years.

Meanwhile, the results of the latest stock number survey on 30 June 2018 have recorded a further decline in the New Zealand national ewe flock. The number of ewes fell 2.1% or from 17.76m head to 17.37m head, with the report pointing to record cull ewe prices as an underlying factor, while there is also an ongoing switch in some regions to less labour-intensive cattle and deer enterprises.

The number of hoggets retained increased from 8.88m head to 9.11m head and while this is seen as a positive factor, it is not comparable to the extent of the reduction in ewe numbers. The knock-on effect of a reduced ewe flock and scanning results falling below expectations is a smaller lamb crop, with estimates pointing to the lamb crop reducing by a massive 900,000 head to 22.78m head.

Heatwave dents UK lamb sales

The AHDB reports lamb sales suffering during the higher than normal temperatures. The report says: “Primary lamb cuts (including chops, mince and roasting joints) suffered badly in the hot weather, with the volume of fresh and frozen lamb cuts declining by 9% year on year in the 12 weeks ending 12 July.”

It also highlights that an increase in the average retail price may also have contributed to the drop in sales. There were significant reductions in nearly all category cuts, with the total spend on fresh and frozen lamb declining 6% compared with earlier levels.

This is in contrast with a significant upturn in fortunes for all competing proteins. Beef burger and grill sales are reported as increasing 19% compared with 2017 levels, with fresh product sales increasing by almost 30%. This was despite a 3% increase in prices. However, primary beef cuts suffered the same fate as lamb cuts, with sales declining 3% despite retail prices falling 0.5%. Pork sales recorded a 1% increase driven by sausages (+4%) and pork pies (+5%) while poultry sales increased 8%, helped by a 3% reduction in average sale prices.

Japan approves US sheep and goat export resumption

US Secretary of Agriculture Sonny Perdue announced on 12 July that the Japanese government had finalised technical requirements that will allow US sheep and goat exports to resume after a 14-year break. Exports halted in 2003 after an outbreak of BSE in the cattle herd. Japan is the leading value market for US beef and pork, with high hopes that lamb will now follow. The USDA reports Japanese sheep and goat meat imports reaching $169m (€146.6m) in 2017 with imports coming primarily from Australia and New Zealand. Japan is another country where pressure has been growing to develop trade links for Irish and EU sheepmeat following last year’s trade announcement for beef.

US 2018 sheepmeat imports increase

Higher processing activity as a result of drought and record prices in Australia has contributed to an increase in US sheep meat imports. USDA market analysis to 11 August shows imports from Australia totalling 36,655t for lamb and 10,580t for mutton, an increase of approximately 9% on 2017 levels.

Imports from New Zealand are also steady, with 17,657t of lamb and 2,753t of mutton imported. The two countries dominate US imports, with just 296t imported from Chile, 70t from Canada, 62t from Uruguay and 34t from Mexico.

Previous reports point to a spike in imports in April and May as inserting pressure on to the US lamb trade and contributing to an increase in the volume of sheepmeat entering into cold stocks before being released for holiday periods. The pressure on the trade has abated, with the latest price report reporting a strengthening in the trade ahead of the Eid al-Adha festival.

The American sheep industry is relatively small, with output on a similar level to Ireland, despite the massive gulf in size between the two countries.

The US ewe flock has been on a declining trend in recent years and recorded a further decrease of 40,000 head to 3,005,000 from January 2017 to 2018. The number of flock replacements recorded stood at 655,000 head, a reduction of 5,000 head on the previous year. Flock productivity is at a lower level, with output estimated at 1.05 lambs per ewe.

However, this is compensated for by sheep being brought to heavier weights. The average liveweight for sheep slaughtered in the week ending 4 August 2018 was recorded at 63kg liveweight and a carcase weight just shy of 32kg.

Weekly throughput is currently averaging around 37,000 head with annual throughput up 2.9% at 1.245m head.

Mayo Mule sale clarification

Last week’s report on the Mayo Mule and Greyface Group introducing a new two-day sales format for the 2018 premier sale incorrectly listed the sale dates for hoggets and ewe lambs.

It should have stated that the premier sale of hoggets takes place on Friday 24 August, with ewe lambs on Saturday 25 August.

EID Sheepnet survey

The Sheepnet project, involving the six main sheep-producing countries in the EU (Ireland, France, Italy, Spain, Romania and the UK) along with Turkey, is seeking sheep producers to complete a survey developed to assess the level of EID technology use among sheep producers. The survey contains simple background questions and aims to gauge farmers’ views on the benefits and/or limitations of EID and reasons for implementing or not implementing EID technology at farm level. It can be accessed at http://limesurvey.idele.fr/index.php/677643/lang-en.

Sheep Ireland ram catalogue

The final catalogue for the Sheep Ireland elite €uro-Star multi-breed ram sale, which takes place this Saturday 25 August in Tullamore Mart, Co Offaly, is available on www.sheep.ie.

The sale of 326 rams from nine breeds – Belclare (42), Beltex (2), Charollais (106), Hampshire Down (4), Lleyn (2), Rouge de l’Ouest (6), Suffolk (58), Texel (93) and Vendéen (13) – commences at 12pm, with sheep sold in two rings. All lambs are five stars on the terminal OR replacement index.

SHARING OPTIONS