The auto-enrolment is a new pension savings scheme that is being introduced in Ireland in 2024 for employees who are not paying into a current pension.

The new initiative marks a significant shift in the pensions landscape, emphasising efforts to create a more robust retirement system.

Employers (including farmers) will bear the responsibility of facilitating contributions. Employees will see the benefits from a simplified savings process as they will automatically be included in the scheme which they can opt out of after six months.

Who will be automatically enrolled?

Anyone who meets the following criteria will be automatically enrolled in the new pensions plan if they are an employee and are:

Aged between 23 and 60.Not currently part of a pensions plan.Currently earning more than €20,000 or more a year.What does this mean for an employer?

If an employer does not meet their auto-enrolment obligations, they will be subject to penalties and possibly prosecution.

If the employee is working part-time and earns less than €20,000, you don’t have to worry about the auto-enrolment scheme, but for any employer including farmers who are paying workers in the earning and age brackets, from 2024 they will have to be on the auto enrolment scheme.

Head of financial planning in ifac Martin Glennon outlines the impact it will have.

Martin Glennon, head of financial planning at ifac.

“The considerations for the employer are they have to sign all employees onto it and the employee has to go onto it for at least six months. It is an opt out system, that means if its anything like the UK [equivalent] you will find 95% of staff will be on the auto enrolment scheme”.

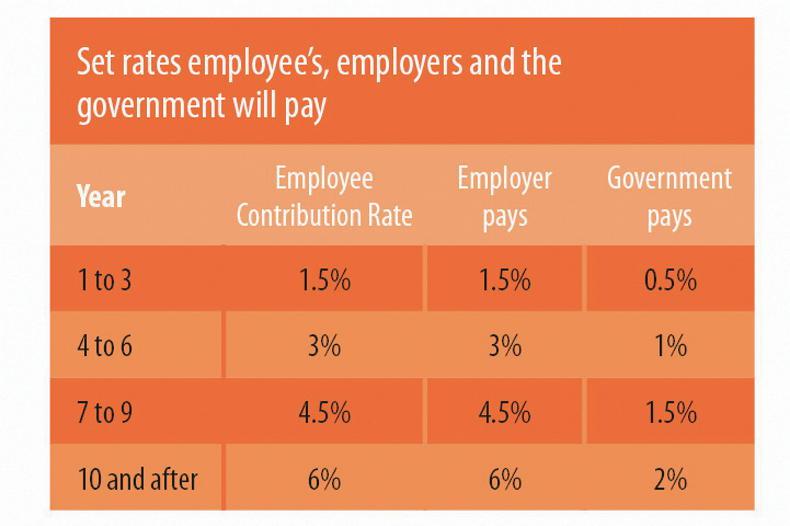

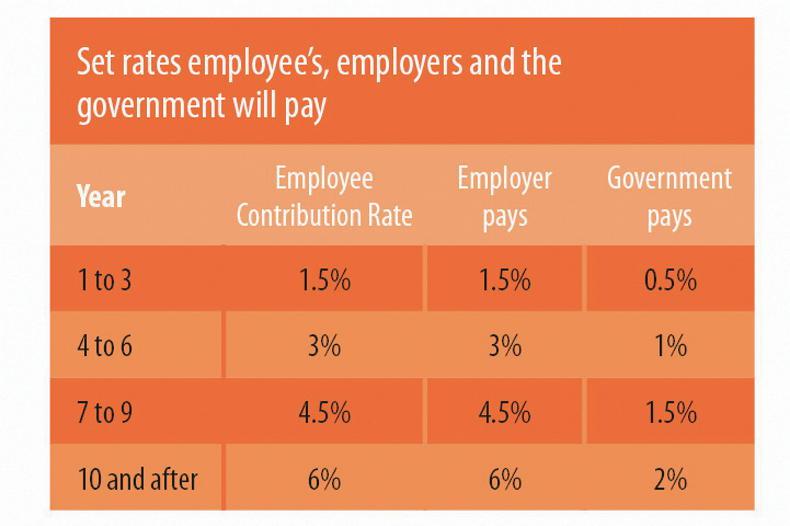

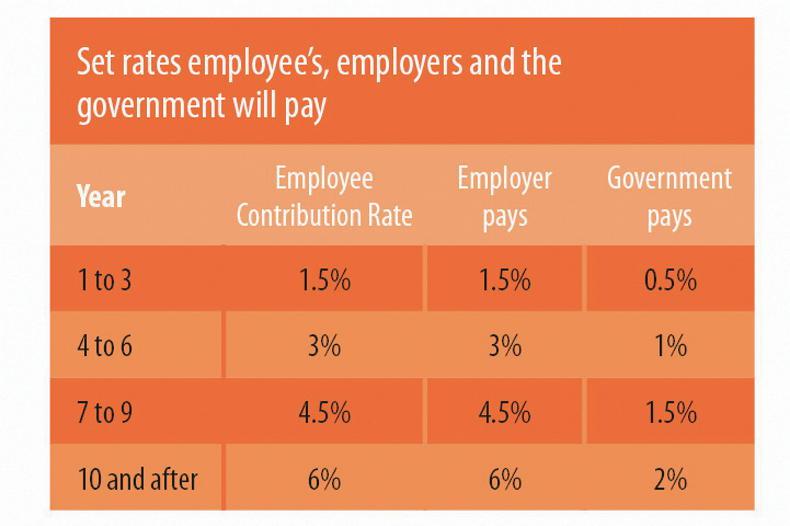

There will be a staggered increase in the cost for employers over a 10-year period. The amount an employee will pay is a set rate of their annual salary. The employer will match the contributions and the Government will contribute an additional amount. You cannot pay more or less than the set rate.

The employee and your employer will pay 1.5% of their annual salary in the first year. This will increase to 6% by year 10.

** Above information is from citizensinformation.ie

Contributions

Both an employer’s and the Government’s contributions are capped at €80,000 gross annual salary. If someone earns over €80,000, they can still contribute but their employer and the government won’t match the contributions on any income over €80,000.

Employers will not need to set up their own scheme or select a savings option for their employees but they will need to make provisions for matching their employee contributions. Farmers and business owners will also need to ensure their current payroll system can cope with the new regime. Employer contributions under auto- enrolment for corporation tax purposes will be deductible.

Considerations for the employer

A number of farmers and employers will have to decide what pensions scheme suits their payroll and business structure best.

“You are going to have certain employees who would benefit better if an occupational pension scheme was in place because they may be paying income tax at the 40% rate.There is no come back for the employer with auto-enrolment. If I have an auto-enrolment scheme and someone comes in and joins the business I have to put them into that scheme. If they are gone after a year, I don’t get any contributions back, the employee has secured those funds in their scheme. Under the occupational pensions scheme you have what’s called a vested period of two years that can protect employers where people are coming and going quickly within a job,” says Martin.

Graph 1.

Read more

Agri Careers: the transformation of agriculture education

57% of students have a positive outlook for farming in Ireland

The auto-enrolment is a new pension savings scheme that is being introduced in Ireland in 2024 for employees who are not paying into a current pension.

The new initiative marks a significant shift in the pensions landscape, emphasising efforts to create a more robust retirement system.

Employers (including farmers) will bear the responsibility of facilitating contributions. Employees will see the benefits from a simplified savings process as they will automatically be included in the scheme which they can opt out of after six months.

Who will be automatically enrolled?

Anyone who meets the following criteria will be automatically enrolled in the new pensions plan if they are an employee and are:

Aged between 23 and 60.Not currently part of a pensions plan.Currently earning more than €20,000 or more a year.What does this mean for an employer?

If an employer does not meet their auto-enrolment obligations, they will be subject to penalties and possibly prosecution.

If the employee is working part-time and earns less than €20,000, you don’t have to worry about the auto-enrolment scheme, but for any employer including farmers who are paying workers in the earning and age brackets, from 2024 they will have to be on the auto enrolment scheme.

Head of financial planning in ifac Martin Glennon outlines the impact it will have.

Martin Glennon, head of financial planning at ifac.

“The considerations for the employer are they have to sign all employees onto it and the employee has to go onto it for at least six months. It is an opt out system, that means if its anything like the UK [equivalent] you will find 95% of staff will be on the auto enrolment scheme”.

There will be a staggered increase in the cost for employers over a 10-year period. The amount an employee will pay is a set rate of their annual salary. The employer will match the contributions and the Government will contribute an additional amount. You cannot pay more or less than the set rate.

The employee and your employer will pay 1.5% of their annual salary in the first year. This will increase to 6% by year 10.

** Above information is from citizensinformation.ie

Contributions

Both an employer’s and the Government’s contributions are capped at €80,000 gross annual salary. If someone earns over €80,000, they can still contribute but their employer and the government won’t match the contributions on any income over €80,000.

Employers will not need to set up their own scheme or select a savings option for their employees but they will need to make provisions for matching their employee contributions. Farmers and business owners will also need to ensure their current payroll system can cope with the new regime. Employer contributions under auto- enrolment for corporation tax purposes will be deductible.

Considerations for the employer

A number of farmers and employers will have to decide what pensions scheme suits their payroll and business structure best.

“You are going to have certain employees who would benefit better if an occupational pension scheme was in place because they may be paying income tax at the 40% rate.There is no come back for the employer with auto-enrolment. If I have an auto-enrolment scheme and someone comes in and joins the business I have to put them into that scheme. If they are gone after a year, I don’t get any contributions back, the employee has secured those funds in their scheme. Under the occupational pensions scheme you have what’s called a vested period of two years that can protect employers where people are coming and going quickly within a job,” says Martin.

Graph 1.

Read more

Agri Careers: the transformation of agriculture education

57% of students have a positive outlook for farming in Ireland

This is a subscriber-only article

This is a subscriber-only article

SHARING OPTIONS: