The Australian National Farmers Federation (NFF) has put the cost of trade disputes at AUS$36.9bn (€23.5bn) this decade in a pre-budget submission to the Australian government.

They are calling for a strategy that “deepens access to existing markets, diversifies export destinations, improves supply chains and builds domestic value-adding capabilities”.

Overall, the NFF is calling for a AUS$3.5bn (€2.23bn) investment by the government over four years to the sector to become a AUS$100bn (€63.7bn) industry by 2030.

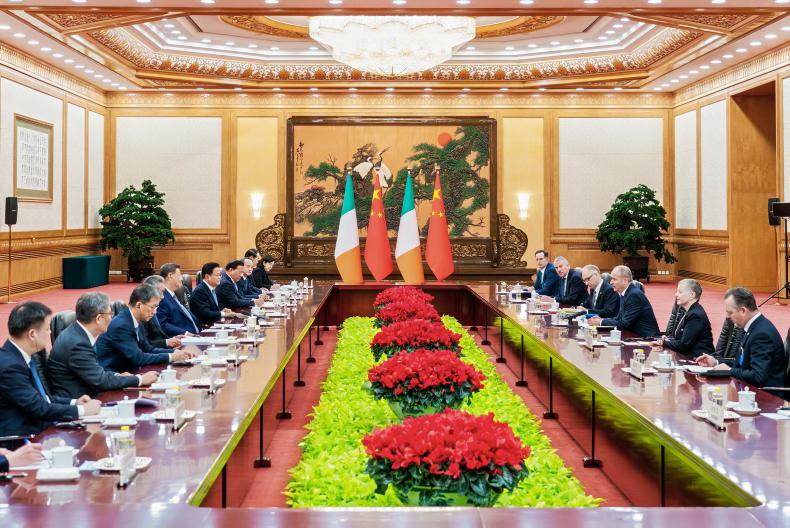

China

Last year, China imposed tariffs on Australian grain and a number of meat factories have been suspended from supplying China because of individual issues.

China has been a key market for both Australian beef and lamb exports in recent years, reaching over 300,000t product weight in 2019, falling back to under 197,000t in 2020.

For lamb, 152,683t product weight was exported to China in 2019, falling back to 118,525t in 2020 (source: Meat and Livestock Australia - MLA).

Emergence from drought

However, it isn’t just trade difficulties that are impacting on Australian beef and lamb exports.

Emergence from prolonged drought in 2020 has meant herd and flock rebuilding, meaning less livestock available for processing.

This has also led to exceptional beef prices, with the most recent MSA steer value reported by MLA at the equivalent of €4.36/kg and lambs at the equivalent of €4.74/kg.

Australia is a major supplier of beef and sheepmeat across the major importing countries in Asia, as well as the USA and Canada.

Volumes to the EU are low, as there isn’t yet a trade deal in place, although a negotiation between the EU and Australia is ongoing.

Similarly, the UK and Australia are in a trade negotiation and the UK has recently applied to join the CPTPP, a trade grouping of Pacific rim countries, of which Australia is a member.

Irish trade

Irish beef exports to China stalled in May 2020 with the discovery of a BSE case leading to a suspension of exports that haven’t yet resumed.

However, Irish pigmeat exports to China remain strong, with 57,633t imported between January and November 2020.

This is up from 47,085t imported for the same period in 2019 and 30,185t imported in the first eleven months of 2018 (source: China customs data, provided by Bord Bia).

Irish dairy exports to China have also been performing strongly.

Between January and November, the value of exports to mainland China was €460.5m, a 10% increase on the same period in 2019 (source: Bord Bia).

SHARING OPTIONS